The number of respondents who said they would be more likely to invest their money in crypto than traditional stocks increased by 140% in just five months.

5059 Total views

71 Total shares

New research by consumer data aggregator CivicScience has found that a growing number of investors are selling their shares to purchase more crypto.

The research questions were sent to people over 18 years old in the United States at varying times during 2021. The results were weighed by U.S. census data. Each question had between 1,000 and 40,600 respondents.

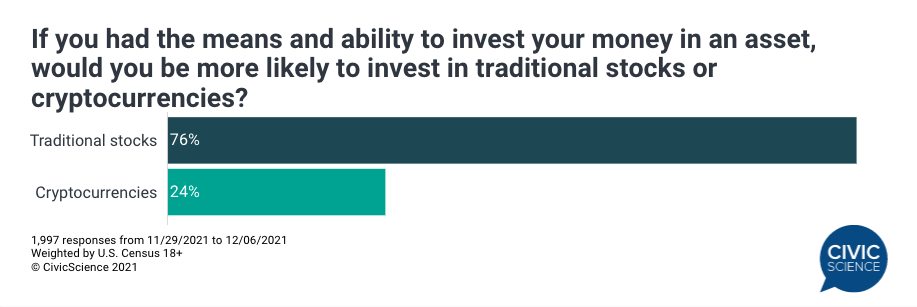

Out of 3,700 respondents surveyed, the number who said they would be more likely to invest their money in cryptocurrency than traditional stocks increased 140% in just five months.

Back in June, only 10% of respondents said they would be more likely to invest their money in cryptocurrency than traditional stocks, which rose to 24% in November.

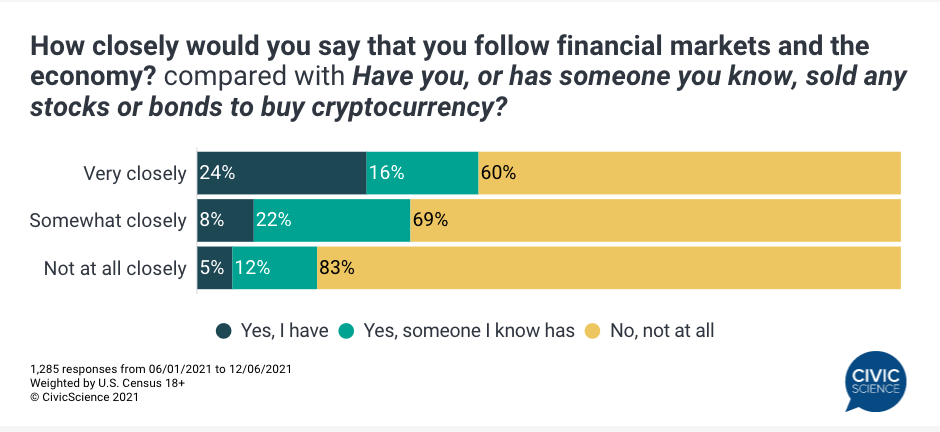

Interesting those who said they follow the financial market and economy “very closely” or “somewhat closely” were more likely to swap their traditional assets for crypto.

Out of the 1,285 respondents who said they follow the market “very closely,” 40% said that they or someone they know has sold their traditional stocks to purchase crypto.

This percentage dropped to 30% for those who follow the market “somewhat closely,” and around 17% for those who said they followed the market “not closely at all.”

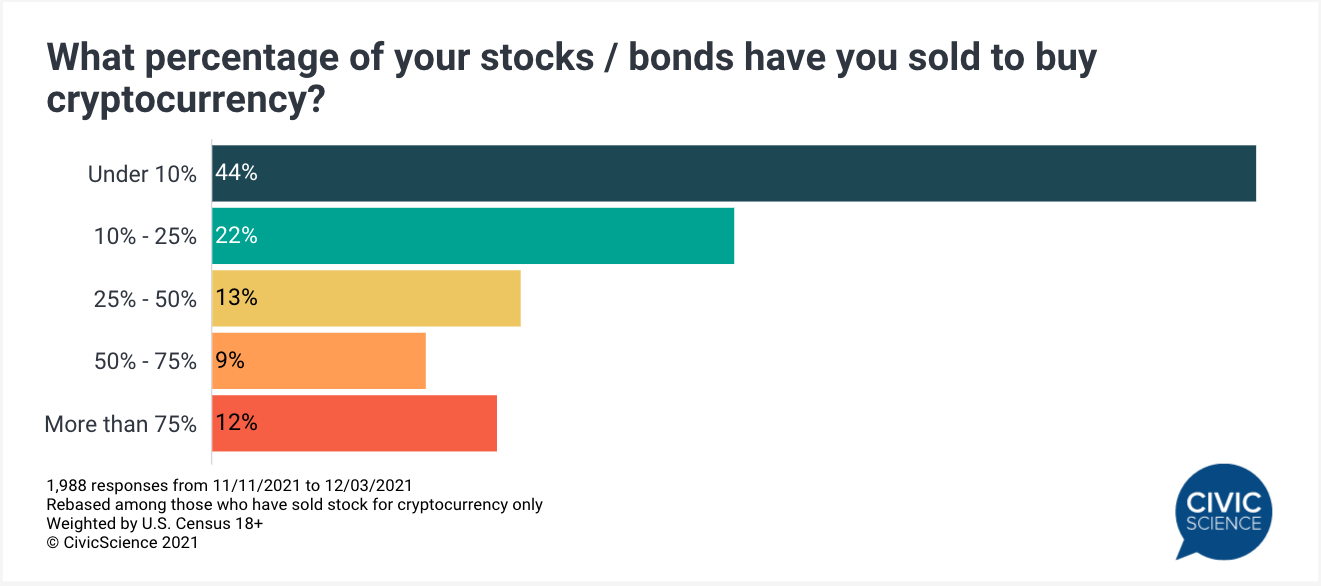

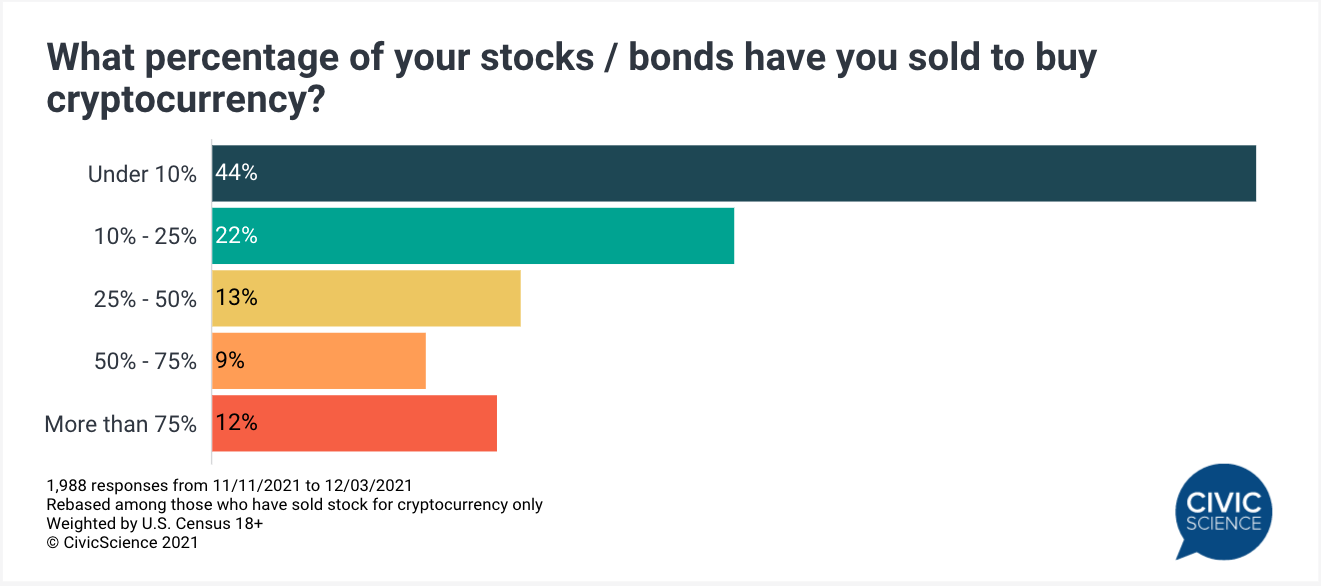

Around 44% of the 1,988 respondents who had sold stocks for crypto said they’d sold less than 10% of their portfolios.

But around one-fifth had sold over half of their stock assets to buy crypto, which Zack Butovich from CivicScience described as a “shockingly significant number.” That might be pushing it, but it’s certainly notable.

Related: True or false: 91% of surveys about Bitcoin and crypto are totally wrong

According to its website, CivicScience sources its data through digital and mobile content partnerships. Cointelegraph contacted CivicScience for more detail on its methodology and is awaiting a response.

CivicScience also found that those not interested in blockchain tech have continued to decline, from 80% in May of this year to 68% currently based on 40,571 responses from May 1 to Dec. 6.

![]()

![]()