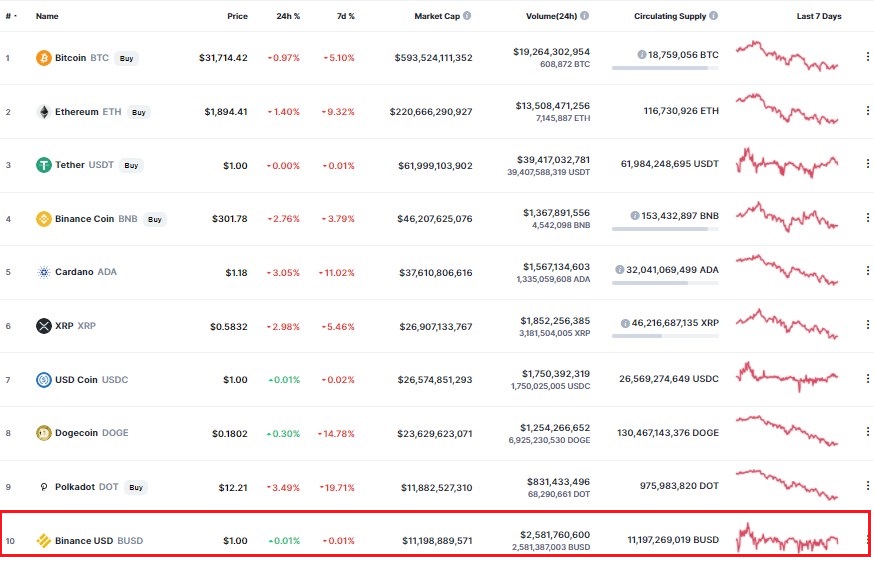

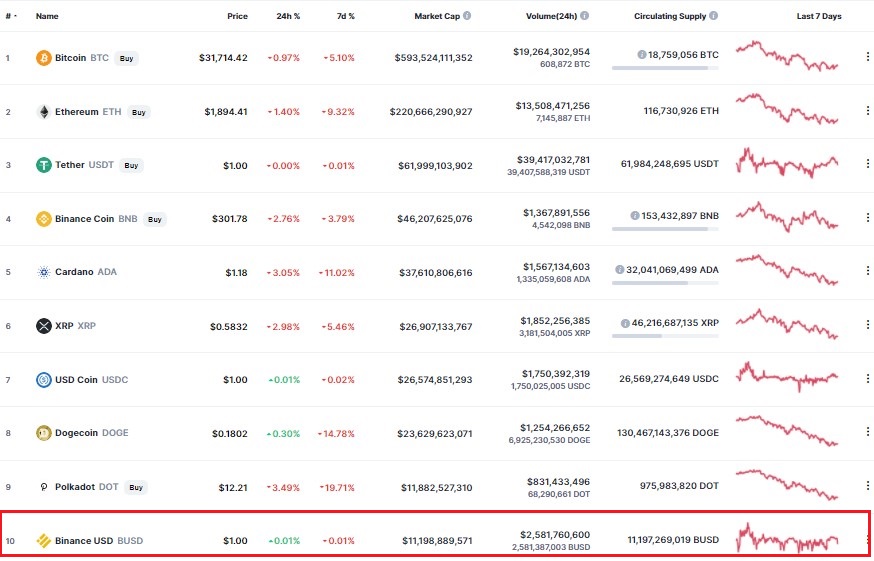

- Binance USD (BUSD) is now ranked 10th on Coinmarketcap

- Binance USD’s market cap has exceeded $11 Billion

- There are now three stablecoins in the top 10 rankings according to market cap

- The use of Binance USD in DeFi is gaining popularity

The Binance USD (BUSD) stablecoin is now a top 10 digital asset on Coinmarketcap.

(adsbygoogle = window.adsbygoogle || []).push({});

Binance USD now has a total market cap of $11.198 Billion as highlighted on the following screenshot courtesy of the tracking website.

3 Stablecoins Are Now in the Top 10

From the screenshot above, it can be observed that three stablecoins are currently in the top 10 rankings according to market capitalization. They include Tether (USDT), USD Coin (USDC) and Binance USD (BUSD).

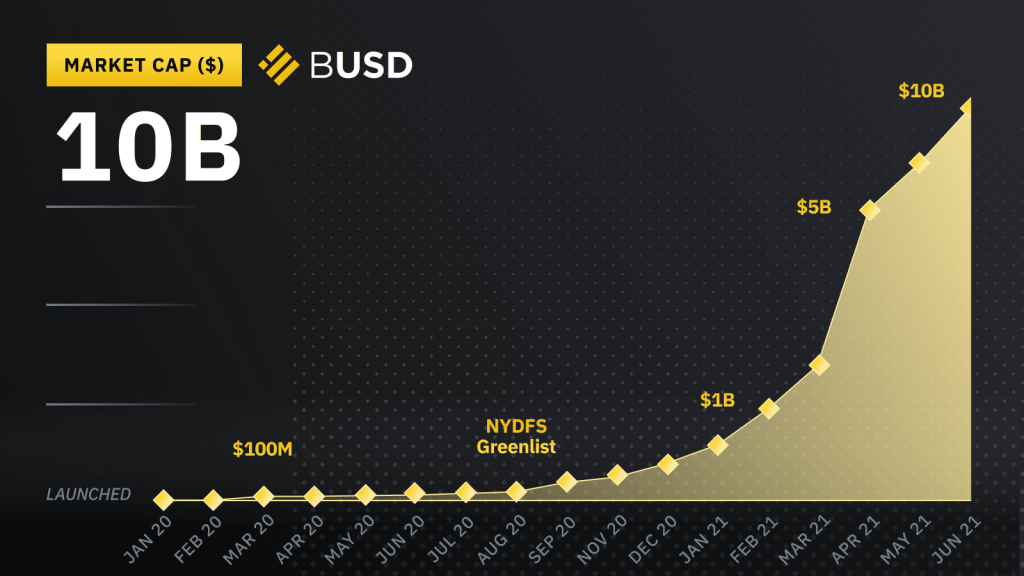

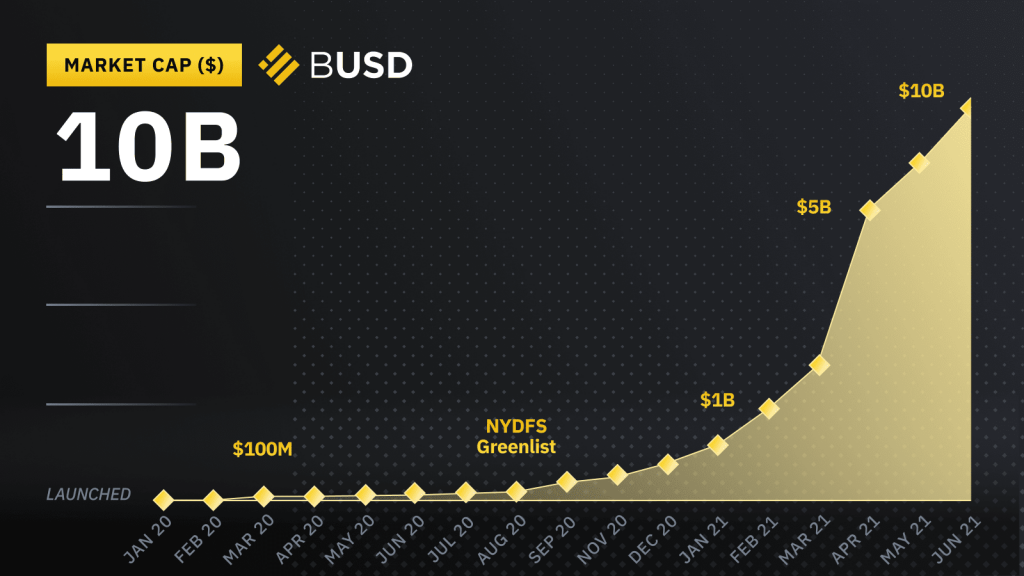

Binance USD’s Market Cap Grew from $1B to $10B in Less than 6 Months

The entrance of Binance USD (BUSD) into the top 10 rankings was also captured by the team at Binance in a recent blog post that pointed out that its market cap grew from $30 million in early 2020, to $1 Billion by the end of the same year. Additionally, Binance USD’s market cap grew from $1 billion to $10 billion in less than six months in 2021.

The growth of Binance USD has been visualized in the following chart courtesy of the team at Binance.

Binance USD is Gradually Taking the Lead in DeFi

The popularity and growth of Binance USD has been due to several factors.

To begin with, the low transaction fees of the Binance Smart Chain make it the preferred stablecoin on the BSC ecosystem, particularly in DeFi.

Secondly, each BUSD is pegged to one US dollar at a ratio of 1:1. In addition, all USD reserves backing Binance USD are held in a 1:1 ratio in FDIC insured banks in the USA and can be redeemed at any time.

Thirdly, Binance USD was approved by the New York State Department of Financial Services (NYDFS) and is issued by Paxos. The stablecoin was also ‘Greenlisted’ by the same NYDFs making it a pre-approved asset for custody and trading by any of the virtual currency licensees issued by the NYDFS.