C98 rallied 1,200% from its ICO price shortly after listing on Binance and AMPL shot higher after the project integrated with AAVE.

(adsbygoogle = window.adsbygoogle || []).push({});

14169 Total views

7 Total shares

Few things in the cryptocurrency space generate more hype than a new token listing because the prospect of finding a rare 1000x coin continues to be a top goal of many crypto investors.

Coin98 (C98) is the most recent example of this phenomenon after the Binance Smart Chain-based decentralized finance (DeFi) solution rallied 1,200% from its initial coin offering price at $0.075 to $0.928 on its first day being listed on exchanges.

— Coin98 Insights (@Coin98Insights) July 23, 2021

Coin98 is the 20th project to come out of the Binance Launchpad and describes itself as “a DeFi gateway for traditional finance users to access any DeFi services on multiple blockchains.”

Along with being listed on Binance, C98 is also available to trade on Gate.io and MEXC Global and token holders can also earn a yield through staking and liquidity pool options on PancakeSwap (CAKE).

Altcoins post double-digit gains

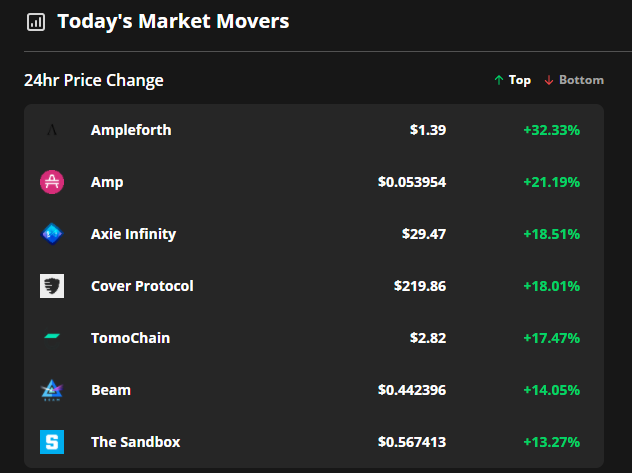

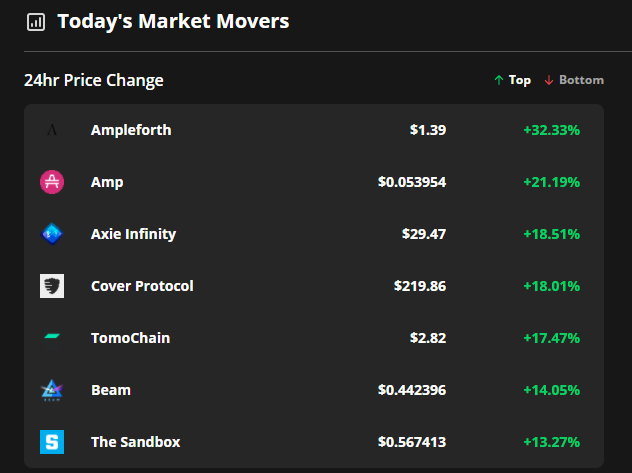

Bitcoin’s (BTC) rally to $33,000 led to a prolonged boost in several altcoins and data from Cointelegraph Markets Pro and TradingView shows Ampleforth (AMPL), Amp (AMP) and Axie Infinity (AXS) as the top movers over the past 24 hours.

AXS’s month-long rally picked up steam again after the price rebounded from its lower support touch at $14 and the rally in AMPL demonstrates the benefit of cross-protocol integrations.

Related: Bull or bear market, creators are diving headfirst into crypto

According to Ampleforth’s Twitter, the new-found interest in AMPL is the result of the token being added to the AAVE DeFi ecosystem

— Richy Qiao (@richy_qiao) July 23, 2021

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for AMPL on July 19, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historic and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen on the chart above, the VORTECS™ Score for AMPL first turned green on July 17 and climbed to a high of 75 on July 19, around 15 hours before the price increased 57% over the next three days.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

![]()

![]()