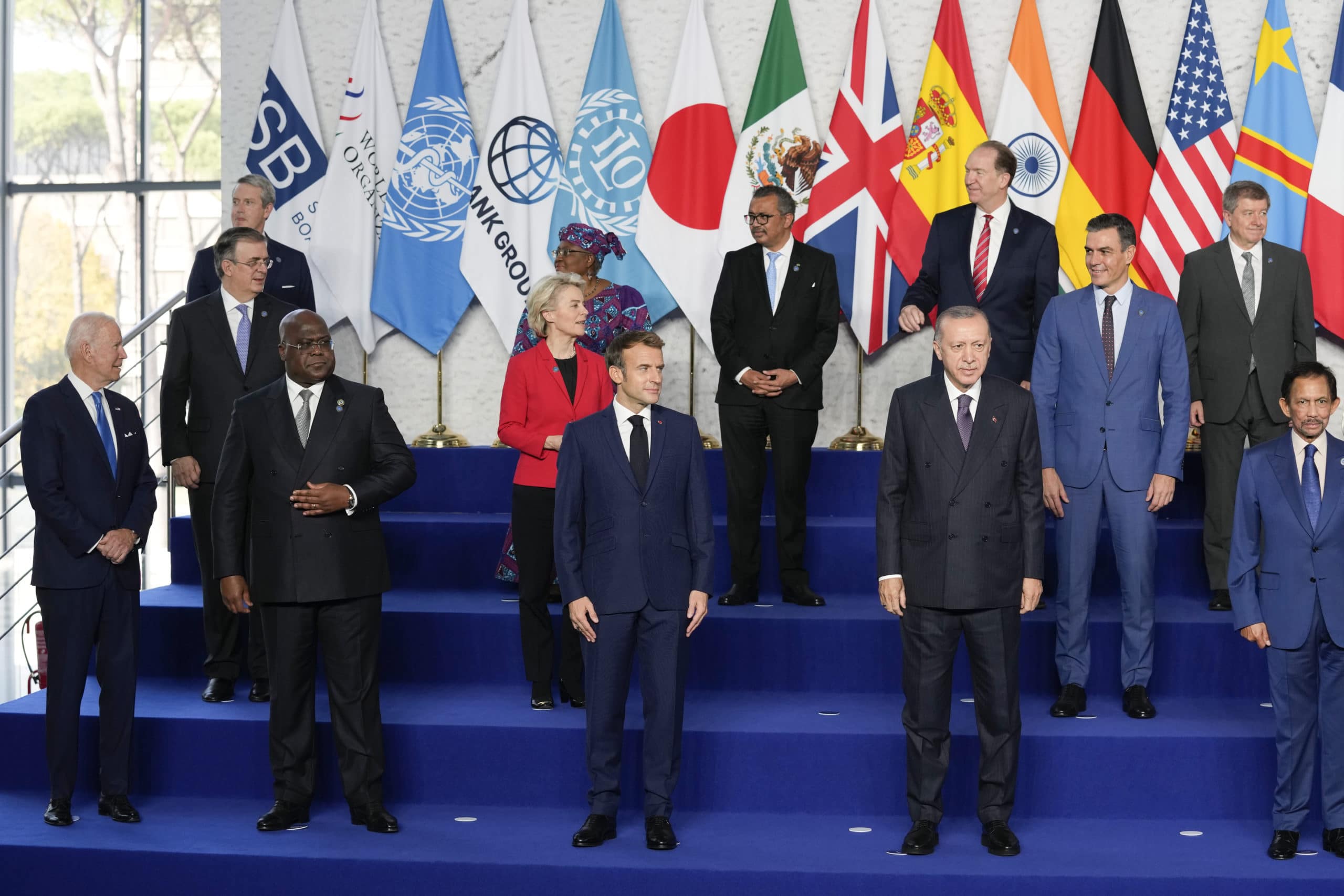

Large tech companies may soon have to pay significant taxes no matter what tax loopholes they had before. BBC News reports G20 leaders have reached an agreement that would set a global minimum tax rate of 15 percent for large companies. The long-in-the-making deal should be official as of today (October 31st) and would be enforced starting in 2023.

The US originally pitched the concept to prevent companies from using creative accounting (such as the “Double Irish arrangement“) to avoid paying most of their taxes in the country. Other countries embraced the idea, though, and the Organization for Economic Co-operation and Development (OECD) told CBC News the move could rake in about $150 billion from corporations around the world.

The deal could discourage tech giants like Amazon, Apple, Google, Meta and Netflix from relying on loopholes to maximize their profits. If the deal collects the promised money, governments could better fund public services and help tackle problems like climate change.

There are numerous criticisms, however, and not just from those who generally oppose higher taxes. Oxfam, for instance, blasted “generous carve outs” that protected sone income and take 10 years to phase out. The pro-equality group also claimed the deal was “extremely limited” and would affect fewer than 100 companies while generating little money for poorer countries. The arrangement might beat the status quo for G20 nations, but it won’t necessarily address some outstanding concerns.

All products recommended by Engadget are selected by our editorial team, independent of our parent company. Some of our stories include affiliate links. If you buy something through one of these links, we may earn an affiliate commission.

Leave a Reply Cancel reply

document.addEventListener(‘DOMContentLoaded’,function(){var commentForms=document.getElementsByClassName(‘jetpack_remote_comment’);for(var i=0;i<commentForms.length;i++){commentForms[i].allowTransparency=false;commentForms.scrolling='no';}}); <!–