- Crowd sentiment towards Bitcoin continues to dip to negative territory

- Bitcoin sentiment is at negative levels last witnessed in October 2020

- At current rates, it could keep falling to negative levels last seen in June 2018

- The Crypto fear and greed index is at 20, its lowest since April 2020

- Bitcoin’s price action remains uneventful with $33k being the level to watch during the weekly close

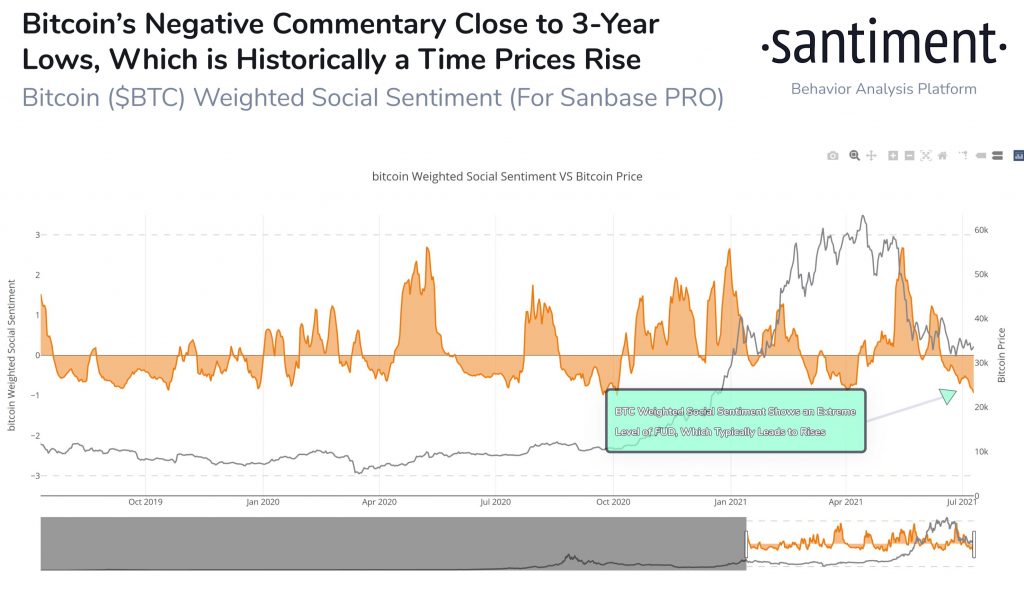

Crowd sentiment towards Bitcoin continues to tread in negative territory. This is according to an analysis shared by the team at Santiment who also pointed out that the current negative sentiment towards Bitcoin is at its lowest since October 2020.

(adsbygoogle = window.adsbygoogle || []).push({});

Furthermore, if the current trend continues, crowd sentiment towards Bitcoin could drop to its most bearish since June 2018 as explained through the following statement and accompanying chart.

The current Bitcoin sentiment remains at extreme negative levels that our algorithm hasn’t seen since October, 2020. If BTC ranges for much longer, the negative commentary will likely surpass this mark, making it the most bearish since June, 2018.

Crypto Fear and Greed Index Drops to 20, Lowest Since April 2020

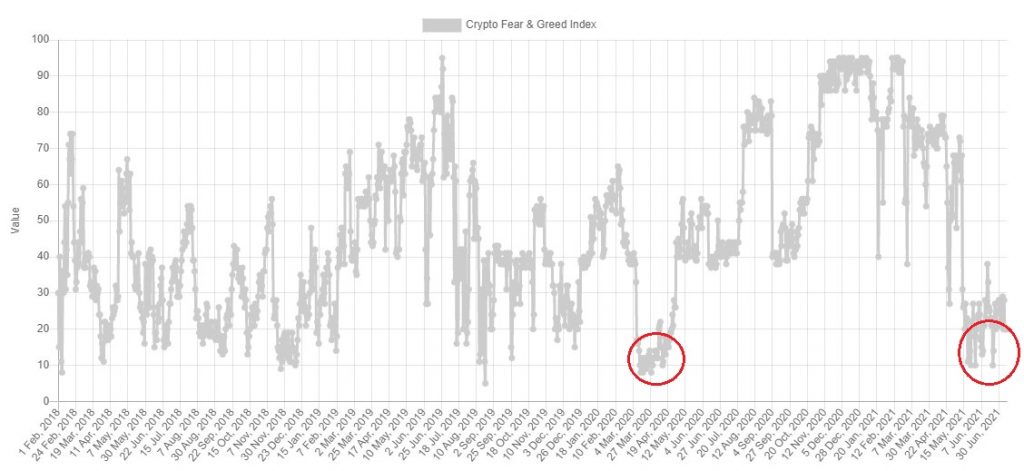

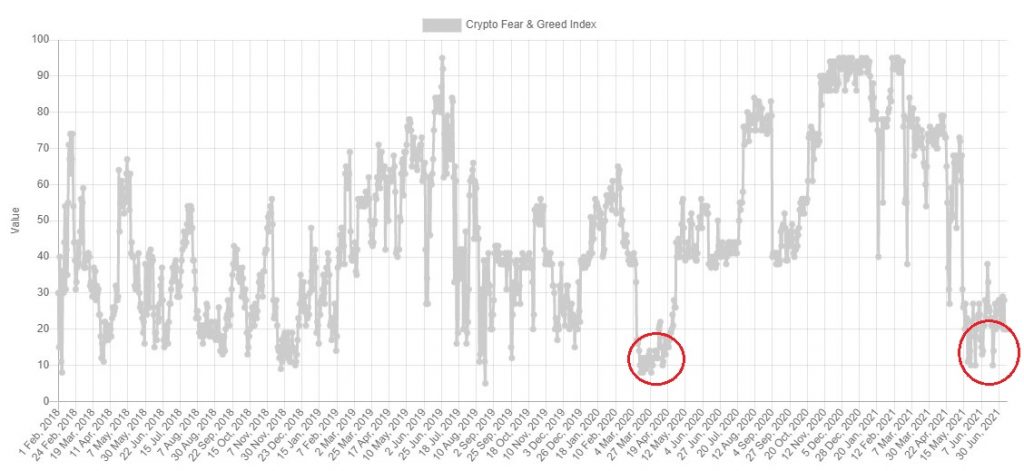

A quick glance at the Crypto Fear and Greed index also reveals a similar scenario in terms of negative sentiment towards the crypto markets. At the time of writing, the Crypto Fear and Greed Index is currently at ‘extreme fear’ at a value of 20 as seen in the screenshot below.

The current level of 20 is also its lowest since the Coronovirus crash of March 2020 and the mood that followed the slow recovery in the month of April of the same year. The similarities between the two time periods in the crypto-verse have been highlighted in the following chart courtesy of Alternative.me.

What Next for Bitcoin in the Crypto Markets?

In terms of price action, nothing much has changed for Bitcoin. The King of Crypto is currently trading at $33,700 with $33k being the support level to watch during tonight’s weekly close.