Bitcoin (BTC) reached its highest level in more than two months with just a few days remaining before the July inflation report.

(adsbygoogle = window.adsbygoogle || []).push({});

The top cryptocurrency climbed 1.65% to $45,363 on Aug.8, continuing the upside momentum that has already seen it jumping 21.62% from its August 5 low of $37,300.

Momentum was strong among the Bitcoin rivals as well. Ether (ETH), the second-largest crypto by market cap, increased 29.78% from its Aug. 3 low of $2,630, crossing over $3,100 on Sunday. Its gains came after Ethereum’s London hard fork went live on Aug. 5, which should add deflationary pressure to the supply of ETH.

July inflation report, on-chain

On Wednesday, Aug.11, the United States Bureau of Labor Statistics will release July’s inflation report, with markets forecasting a 0.5% spike. The projections appear after the consumer price index (CPI) jumped to 5.4% year-over-year in June to log its biggest increase in 13 years.

Bitcoin bulls have responded positively to the recent inflation reports. They effectively guarded the cryptocurrency against falling below $30,000 after the May 19 crash. Meanwhile, their recent efforts to push the prices above $40,000, eventually leading into a slow upside break above $45,000, indicates strong demand for Bitcoin, which appears to be breaking out of its summer slump.

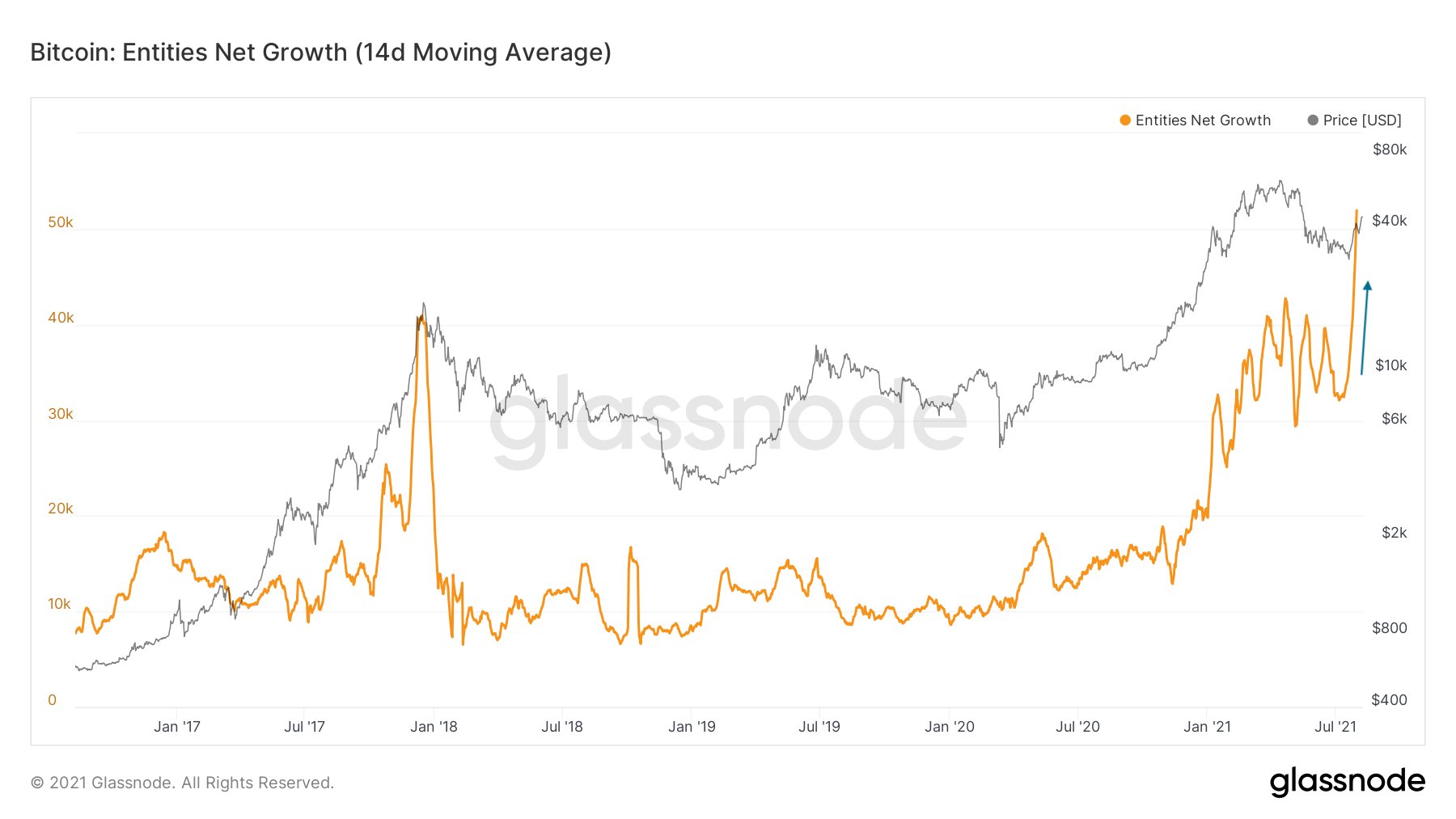

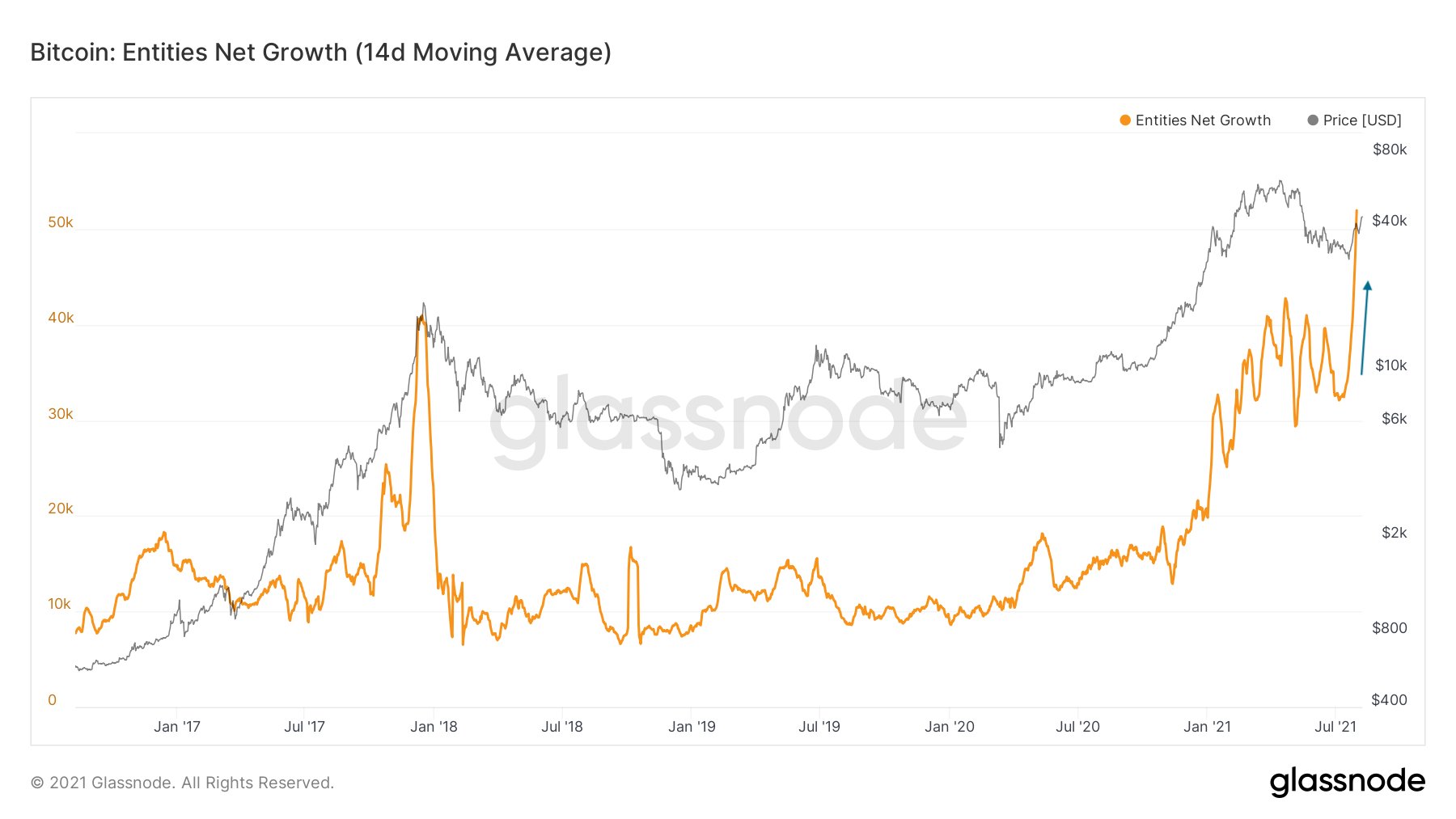

Lex Moskovski, chief investment officer at Moskovski Capital, highlighted a Glassnode chart that showed dramatic spikes in entities entering the Bitcoin network, matching the growth with the rising BTC/USD rates.

“Amount of new Bitcoin entities continues to hit all-time high,” Moskovski tweeted.

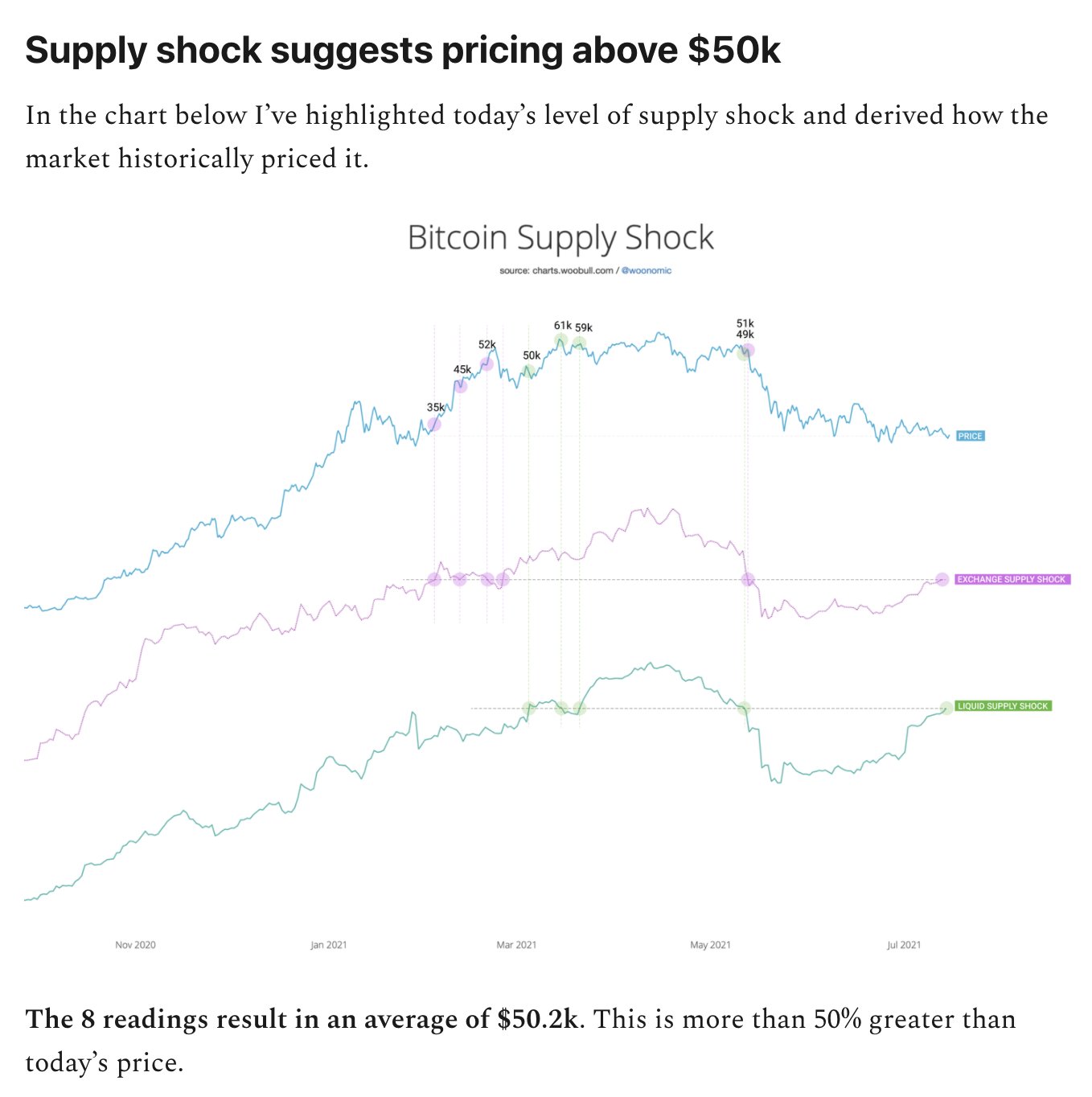

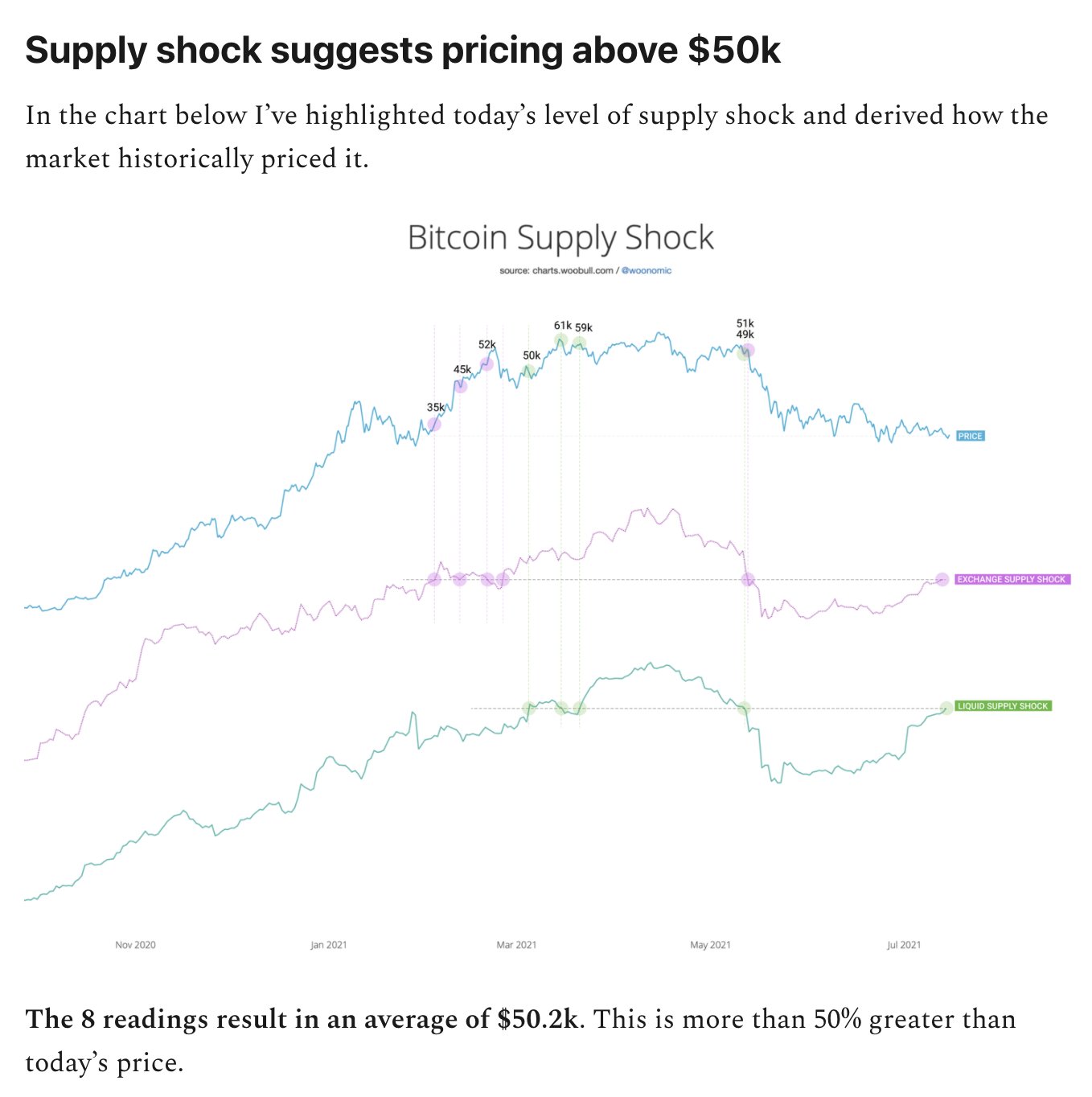

Additionally, on-chain analyst Willy Woo said the ongoing Bitcoin momentum should push its prices above $50,000, citing supply-demand imbalance in the market. He said that all investor cohorts were buying Bitcoin, which led to supply shock.

Related: Here’s what traders expect now that Ethereum price is over $3,000

Woo referred to a chart he posted on July 15 when Bitcoin market was correcting lower after peaking out sessional at $36,675. The graph, as shown below, highlighted events of Bitcoin liquidity shock across all the exchanges and their relation to the prices.

Woo explained:

“Fundamentals do not predict short-term price, but given enough time price discovery reverts to fundamentals. [The] exact value is $53.2k today, with a standard deviation band between $39.6k – $66.8k (68.5% confidence).”

Bearish fractal

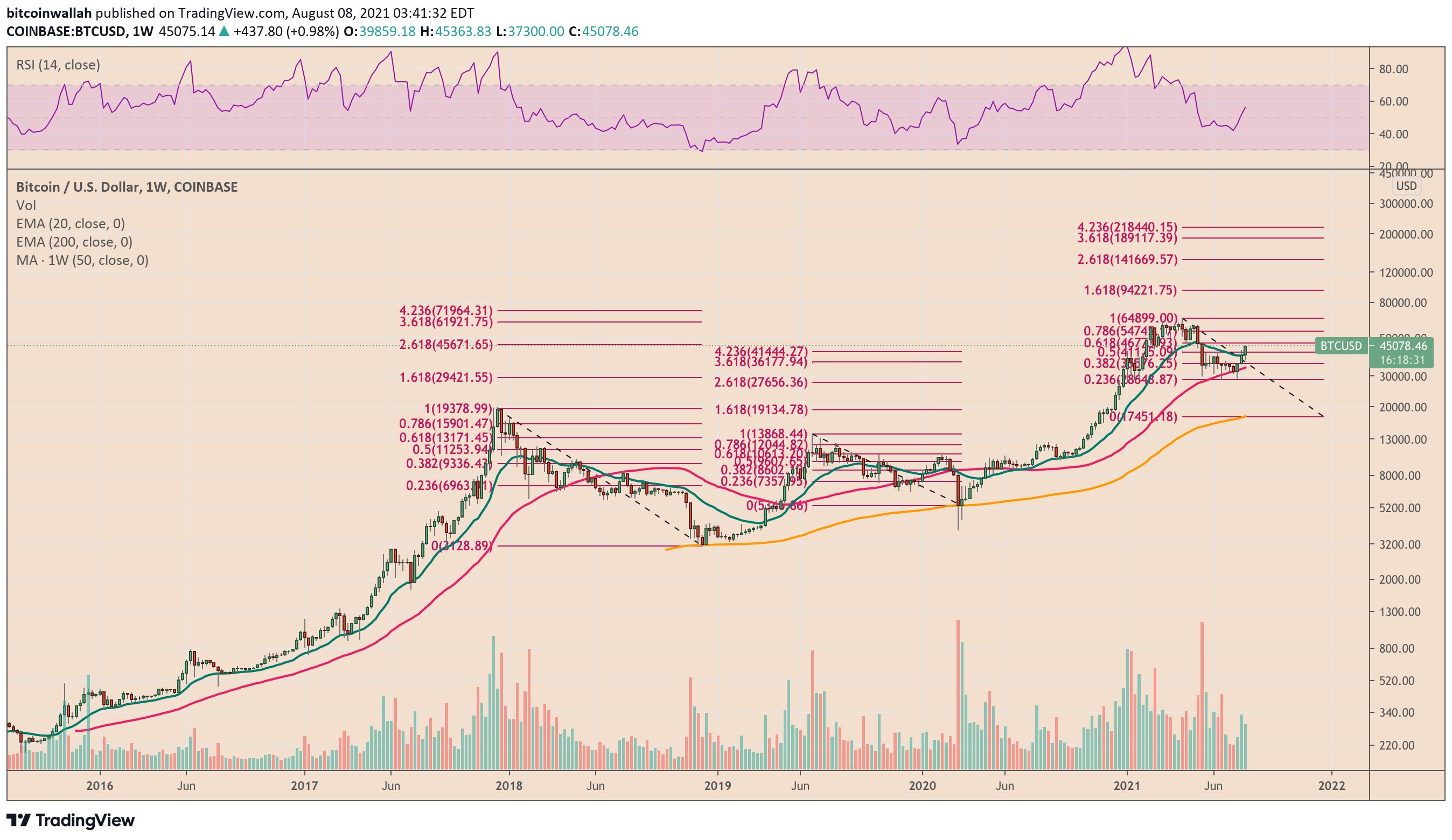

However, the latest Bitcoin climb does carry risks of becoming a dead cat bounce based on previous top-to-bottom Fibonacci retracement fractals.

After setting up record highs, Bitcoin tends to correct toward its 200-week exponential moving average (200-week EMA; the yellow wave), where it eventually bottoms out to pursue another bullish cycle.

In the past two events, the BTC/USD exchange rate posted fake recovery rallies after testing the 23.6 Fib line as support. Those upside moves failed short of turning into big bullish momentums after facing resistance at higher Fib levels.

Related: 3 reasons why Ethereum is unlikely to flip Bitcoin any time soon

For instance, in 2019, Bitcoin rebounded by more than 50% after bouncing off from its 23.6 Fib line near $7,357. But the cryptocurrency faced extreme selling pressure near its 61.8 Fib line of $10,613. Eventually, it resumed its downtrend and crashed to as low as $3,858 in March 2020.

If the fractal repeats, Bitcoin could face extreme resistance at 61.8 Fib level at $46,792 and correct lower to retest its 200-day EMA, which currently sits below $20,000.

Independent market commentator and trader Keith Wareing suggested that an imminent bullish crossover between Bitcoin’s two weekly moving averages hints at the beginning of a multi-month bull run. Dubbed as MACD, the indicator was instrumental in predicting the 2020 bull run.

“The weekly MACD is due to cross bullish on Bitcoin after tonight’s close,” opined Wareing to his followers with the price of Bitcoin so far maintaining above $44,500 at the time of writing.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.