The price of bitcoin is down more than 33% from the crypto asset’s all-time high captured about a month ago on November 10. A while back, people expected the price of bitcoin to be extremely bullish during the months of November and December, and many expected a $100K bitcoin price by the year’s end. However, during the last 13 years, more so than not, bitcoin prices are typically bearish in the last two months of the year.

The End of 2021’s Bearish Market Sentiment Is a Common Occurrence, Looking at Previous Bitcoin Years

There have been a few occasions when BTC had a monumental November and December run in terms of price gains. This year has not been so bullish and people don’t realize that for most of bitcoin’s life, these months have been bearish a majority of the time. For instance, after bitcoin started seeing real-world value and a USD exchange rate in September through November 2010, after November 10, just like this year, BTC’s price slid from a high of $0.35 per unit to $0.17 by December 10, 2010. That’s a 51.42% loss in bitcoin’s fiat value over 30 days over 11 years ago.

In 2011, BTC had a decent bull run jumping from $2 per unit in mid-November that year to $6 by the year’s end, or a 200% increase in USD value. In 2012, bitcoin (BTC) meandered between $10 and $13.50 during the months of November and December. The price had already tapped $13.50 per coin in August and remained lackluster until January 2013. In 2013 during the months of November and December, BTC’s price was once again bullish. In mid-December 2013, BTC’s price came awfully close to $1,200 per coin.

The months of November and December 2014 were bearish as BTC slipped from $471 per coin in mid-September to just above $300 per coin by mid-December 2014. The price of BTC lost 33.12% during that period of time in 2014. The price of BTC in 2015 was again bearish during the two months and in 2016 the price was bullish in November and December. 2017 was a bullish time for BTC during those two months, as the price came very close to $20K per unit.

The following year, during the first week of November 2018, BTC’s price was bearish and valued at $6,376 per unit. By the first week of December 2018, the price was $4,139 per BTC. It’s safe to say that those two months were bearish and by the year’s end BTC was trading for $3,865 per unit. In 2019, around October, BTC was swapping for $9,223 per BTC and on November 4, 2019, it was trading for $9,424 per coin. Ten days later BTC was swapping for $8,639.18 and by December 23, 2019, bitcoin was exchanging hands for $7,324 per unit. The last two months of 2019 were definitely bearish in terms of price movement.

Following 2020’s Bullish Rise in November and December, Bitcoin’s Price Still 90% Higher Than Last Year

The end of 2020 was decent for bitcoin (BTC) prices and by October 13, 2020, bitcoin’s value was $11,425 per coin. Ten days later the price was $12,931 and by the end of 2020 on December 23, BTC was swapping hands for $23,241 per unit. The data clearly shows that November and December 2020 were considered a bullish two months for bitcoin (BTC). Of course, we all know what happened in 2021, and the new bitcoin price highs that were recorded this year.

Despite BTC being 33% below the crypto asset’s all-time high of $69K per unit, it is still 90% above the price it held this time last year. However, bitcoin’s (BTC) price sentiment in November and December 2021 has been bearish and in a continuous downtrend. Bitcoin advocates will have to wait and see how the rest of December 2021 plays out and if it miraculously changes from bearish to bullish by then, or by the first month of 2022.

If the last two months of the first year of bitcoin (2009, with no real-world prices) are considered bearish, and 2021’s November and December are also deemed bearish, then only 5 out of the 13 years of bitcoin’s existence have seen the November and December time interval as bullish for BTC.

Tags in this story

2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, All time high, ATH, Bear, Bearish, Bearish Sentiment, Bitcoin (BTC), BTC Prices, Bull, Bullish, Bullish sentiment, December, holidays, Market Prices, Markets, November, Price Highs, Price per unit, Year End

What do you think about bitcoin’s price during the last two months of every year? Would you consider 2021’s November and December bearish? Let us know what you think about this subject in the comments section below.

Jamie Redman

Jamie Redman is the News Lead at Bitcoin.com News and a financial tech journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written more than 4,900 articles for Bitcoin.com News about the disruptive protocols emerging today.

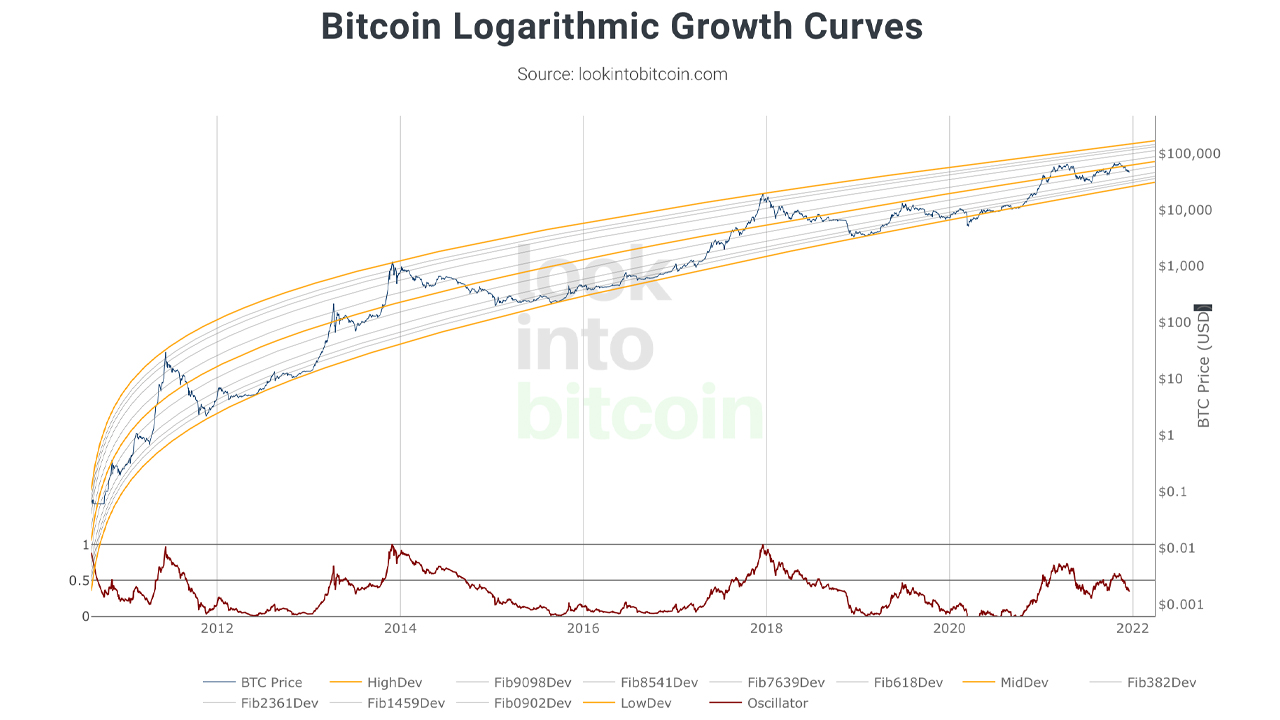

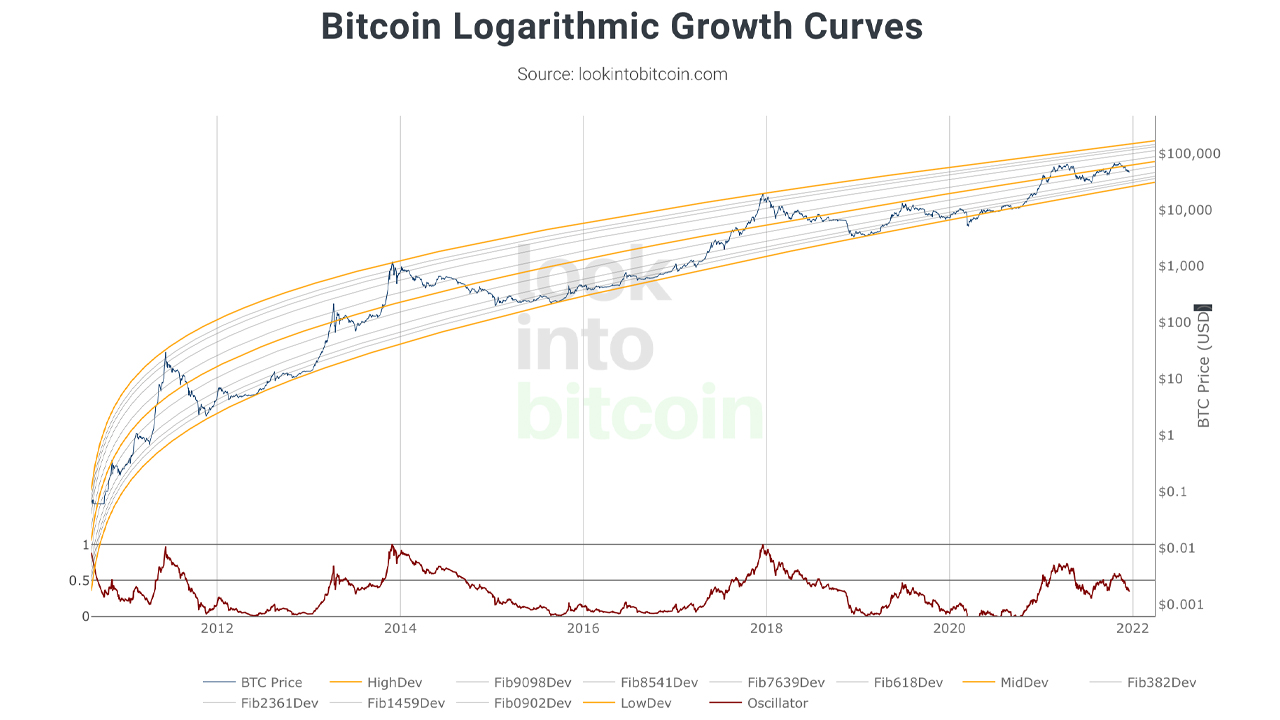

Image Credits: Shutterstock, Pixabay, Wiki Commons, lookintobitcoin.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.