Being bullish on Ether (ETH) has paid off recently because the token gained 60% in the last 30 days. The spectacular growth of decentralized finance (DeFi) applications likely fueled inflow from institutional investors, and the recent London hard fork implemented a fee burn mechanism that drastically reduced the daily net issuance.

(adsbygoogle = window.adsbygoogle || []).push({});

Although Ether is not yet a fully deflationary asset, the upgrade paved the way for Eth2, and the network is expected to abandon traditional mining and enter the proof-of-stake consensus soon. Ether will then be slightly deflationary as long as fees remain above a certain threshold and the level of network staking.

In light of the recent rally, there are still daily calls for Ether to rally above $5,000, but surely even the most bullish investors know that a 90% rally from the current $3,300 level seems unlikely before year-end.

It would seem more prudent to have a safety net if the cryptocurrency market reacts negatively to the potential regulation coming from the United States Representative Don Beyer of Virginia.

Despite being in its early stages, the “The Digital Asset Market Structure and Investor Protection Act of 2021” proposal seeks to formalize regulatory requirements for all digital assets and digital asset securities under the Bank Secrecy Act, classifying both as “monetary instruments.”

Reduce your losses by limiting the upside

Considering the persistent regulatory risks that exist for crypto assets, finding a strategy that maximizes gains up to $5,000 by year-end while also simultaneously limiting losses below $2,500 seems like a prudent and well-aligned decision that would prepare investors for both scenarios.

There’s no better way to do this than using the “Iron Condor” options strategy that has been slightly skewed for a bullish outcome.

The call option gives the buyer the right to acquire an asset at a fixed price in the future. For this privilege, the buyer pays an upfront fee known as a premium. Selling a call option, on the other hand, creates a negative exposure to the asset price.

The put option provides its buyer the privilege to sell an asset at a fixed price in the future, a downside protection strategy. Meanwhile, selling this instrument offers exposure to the price upside.

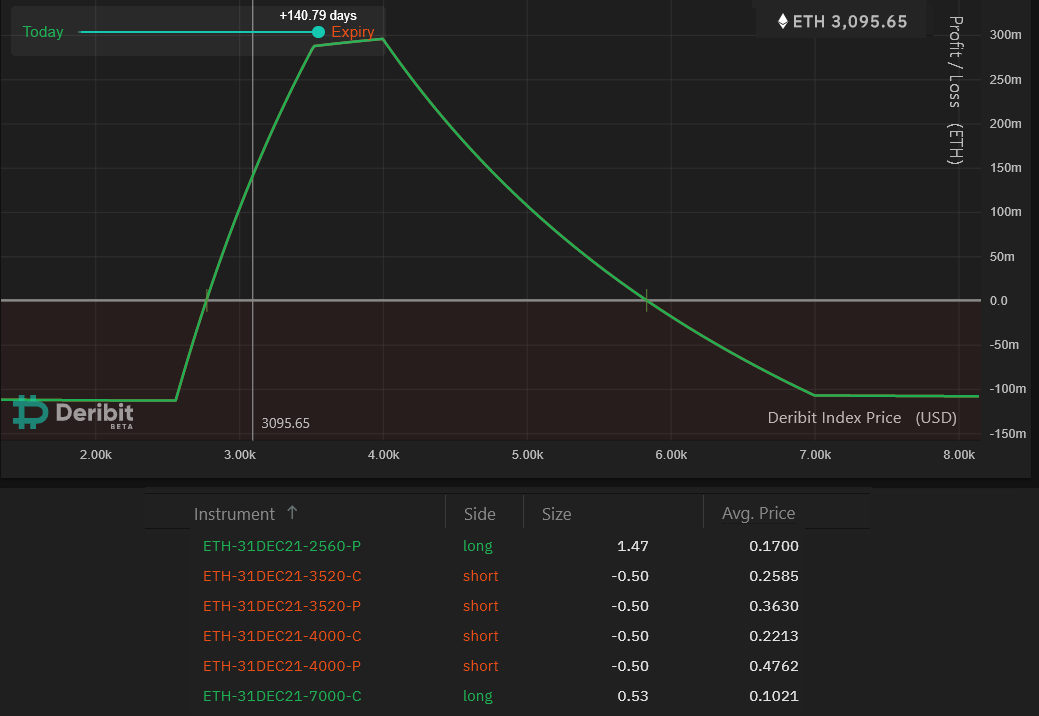

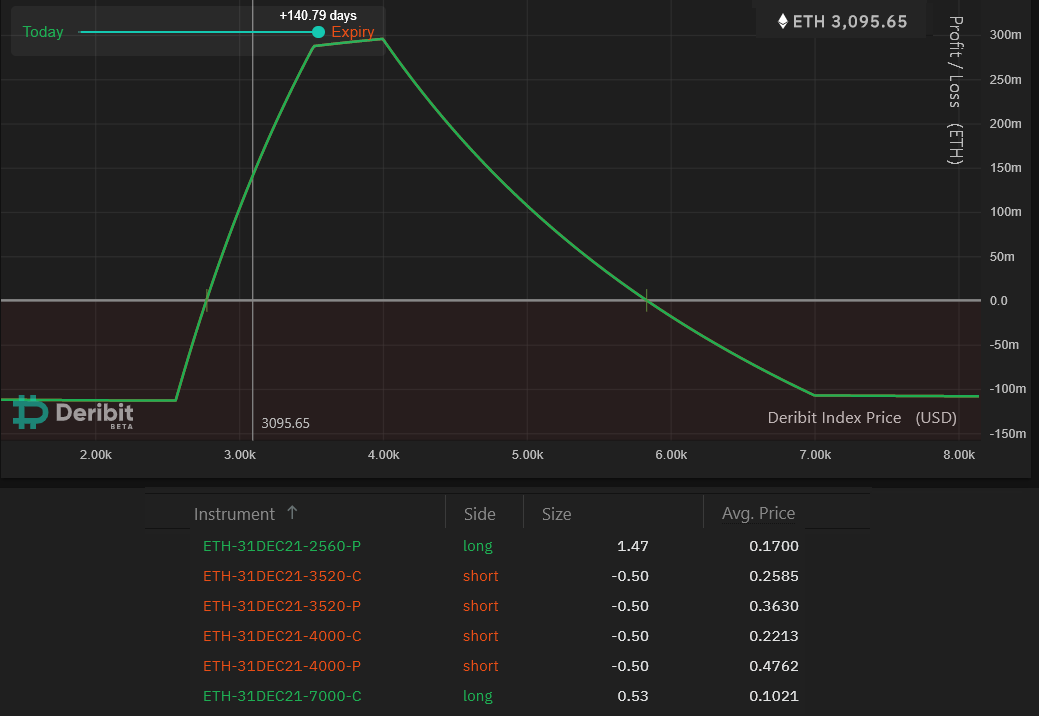

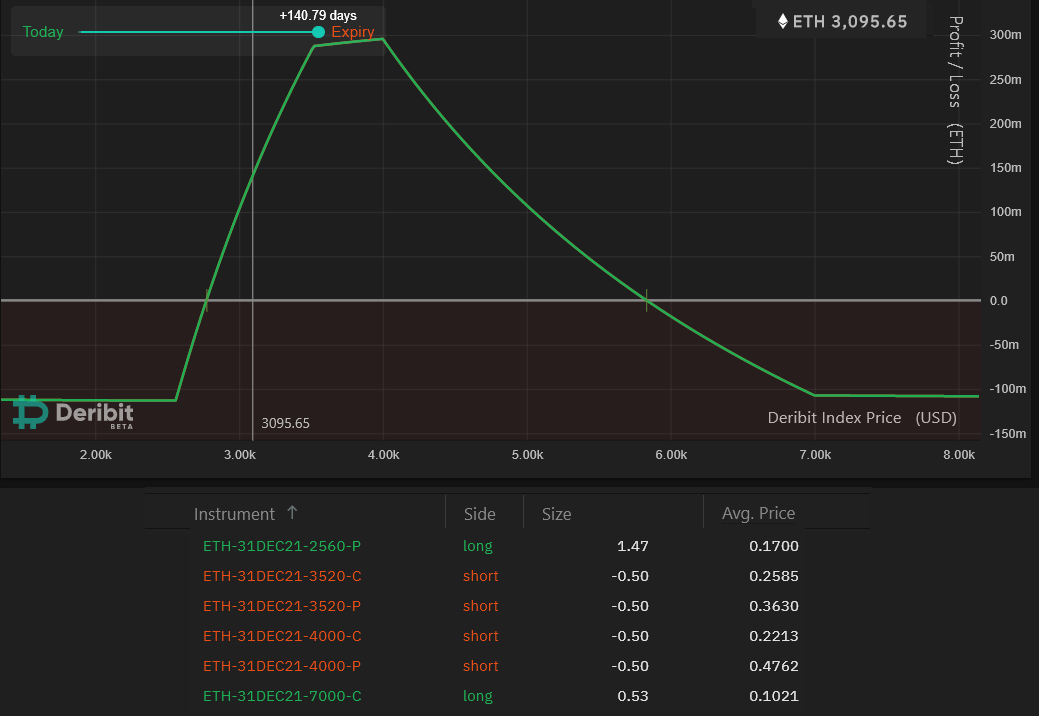

The iron condor basically sells both the call and put options at the same expiry price and date. The above example has been set using the ETH December 31 options at Deribit.

The max profit is 2.5x larger than the potential loss

The buyer would initiate the trade by simultaneously shorting (selling) 0.50 contracts of the $3,520 call and put options. Then, the buyer needs to repeat the procedure for the $4,000 options. To protect from extreme price movements, a protective put at $2,560 has been used. Consequently, 1.47 contracts will be necessary depending on the price paid for the remaining contracts.

Lastly, just in case Ether’s price rips above $7,000, the buyer will need to acquire 0.53 call option contracts to limit the strategy’s potential loss.

Although the number of contracts on the above example aims for a maximum ETH 0.295 gain and a potential ETH 0.11 loss, most derivatives exchanges accept orders as low as 0.10 contracts.

This strategy yields a net gain if Ether trades between $2,774, which is 10.5% below the current $3,100 price, and $5,830 on December 31.

By using the skewed version of the iron condor, an investor can profit as long as the Ether price increase is lower than 88% by year-end.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.