Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Indian crypto exchange CoinSwitch Kuber raises $260M

Indian crypto exchange CoinSwitch Kuber closed a $260 million Series C funding round this week at a valuation of $1.91 billion, adding itself to the prestigious unicorn club.

The funding round was led by Coinbase Ventures and Andreessen Horowitz, the latter of which has emerged as a leading crypto venture capital firm. Following the $1.91 billion valuation, CoinSwitch Kuber is said to be India’s most valued crypto firm.

Speaking of funding, Sky Mavis, the developers of the immensely popular NFT game Axie Infinity, announced a $152 million Series B funding round on Tuesday. Unsurprisingly, Andreessen Horowitz backed the funding round along with participation from FTX.

Ethereum fractal from 2017 that resulted in 7,000% gains for ETH appears again in 2021

The same set of bullish indicators that sent Ether (ETH) surging 7,000% in 2017 has appeared again in 2021, suggesting that the asset is on track to reach the moon before Dogecoin (DOGE).

The fractal indicator from 2017 consists of at least four technical patterns that were instrumental in pushing the price up, including the relative strength index (RSI), stochastic RSI, bullish hammer, and a Fibonacci retracement level.

At the time of writing, Ether is worth $3,600, indicating that the price could hit $13,000 if history repeats itself.

Federal High Court of Nigeria approves eNaira CBDC rollout

The Nigerian Federal High Court has approved the rollout of the eNaira central bank digital currency (CBDC).

The CBDC was launched for beta testing on the nation’s 61st Independence Day celebration on Oct. 1 and has now been given the green light to circulate alongside its fiat counterpart. The CBDC is being touted as a faster, cheaper and more secure option for transactions. It will also be supported by an eNaira wallet.

The official eNaira website says that the digital version of the Nigerian naira will be made available universally, stating that “anybody can hold it.”

Judge rejects XRP hodlers’ bid to join SEC against Ripple case as defendants

The ongoing legal dispute between Ripple Labs and the United States Securities and Exchange Commission (SEC) has taken another turn as U.S. District Judge Analisa Torres ruled on Monday that individuals holding XRP tokens cannot act in Ripple’s ongoing lawsuit as defendants.

The ruling came after several ambitious XRP hodlers aimed to file “friends of the court” briefs which, if granted, would enable them to join the bloody battle as defendants, alongside Ripple, against SEC assertions of XRP being a security.

The judge said the ruling was for their own good, as it would compel the trigger-happy SEC to take action against the XRP hodlers as well. However, it was determined that they could participate as “amicus curiae” — a party that is not involved in the litigation but is allowed by the court to advise or provide information.

Bitcoin returns to $1T asset as BTC price blasts to $55K

Bitcoin (BTC) returned to its $1 trillion asset status this week as the price surged past $55,000.

It appears that the damage caused by the China mining ban in May has been wiped clean, suggesting that there could be a run to new all-time highs in the coming weeks or months. At the time of writing, BTC is worth $54,900 and sits 14.9% below the all-time high.

“Honestly, I think we’ll be continuing to see strength on Bitcoin,” Cointelegraph contributor Michaël van de Poppe said, adding:

“USDT pairs will be fine on altcoins, but perhaps we’ll be having 6-8 weeks of some corrections on the $BTC pairs, before a new party starts. December/January is often the best period to buy alts.”

Winners and Losers

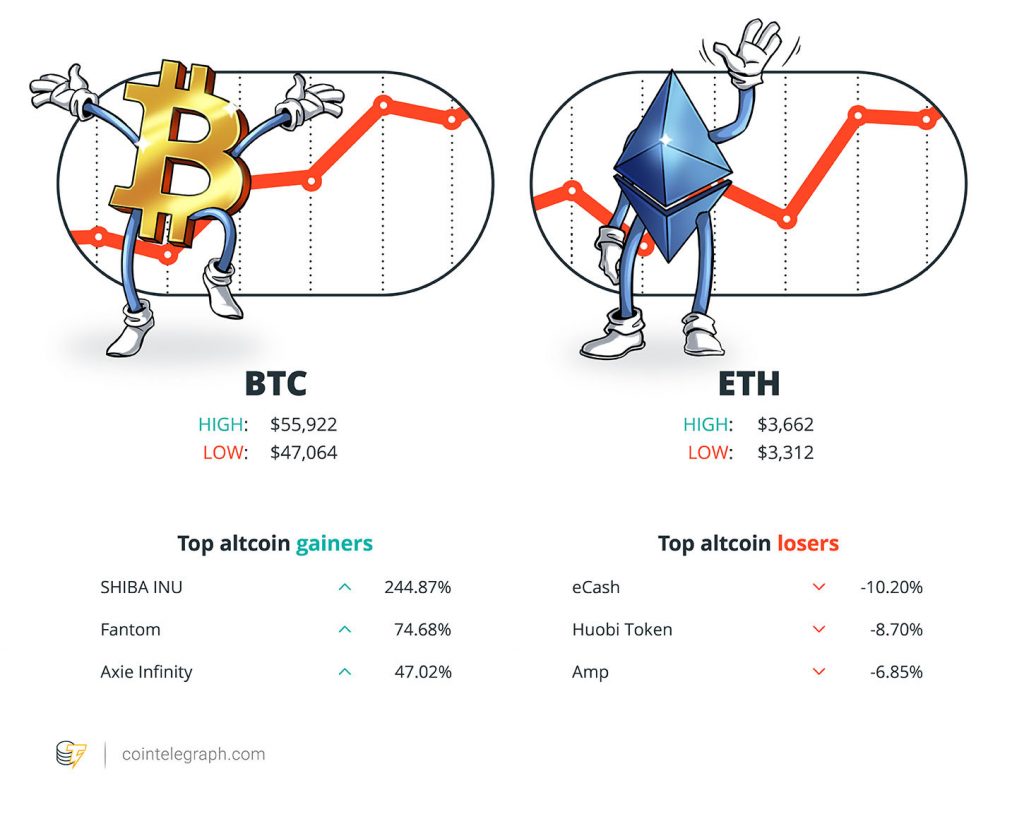

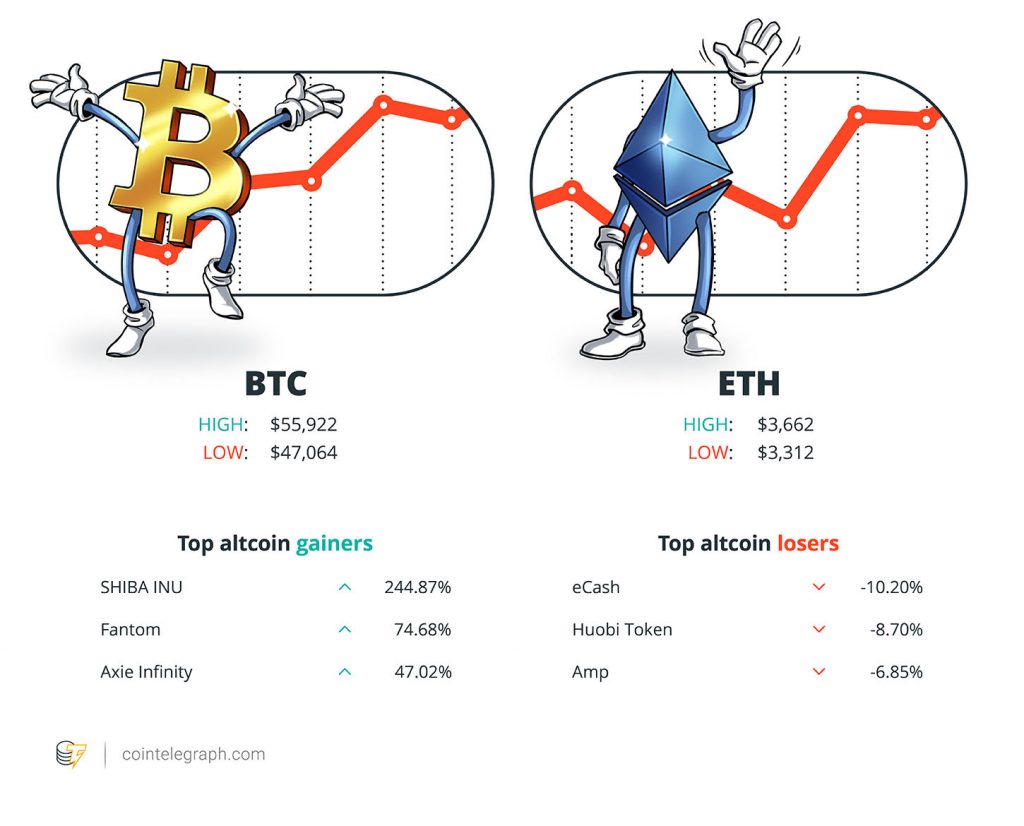

At the end of the week, Bitcoin is at $54,176, Ether at $3,612 and XRP at $1.07. The total market cap is at $2.30 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are SHIBA INU (SHIB) at 244.87%, Fantom (FTM) at 74.68% and Axie Infinity (AXS) at 47.02%.

The top three altcoin losers of the week are eCash (XEC) at -10.20%, Huobi Token (HT) at -8.70% and Amp (AMP) at -6.85%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“Policymakers should implement global standards for crypto assets and enhance their ability to monitor the crypto ecosystem by addressing data gaps. […] Emerging markets faced with cryptoization risks should strengthen macroeconomic policies and consider the benefits of issuing central bank digital currencies.”

“For us, digital assets are not about payments per se. They’re about a new computing paradigm – a programmable computer that is accessible everywhere and to anyone and owned by millions of people globally.”

“We did a survey of our membership, and it was very impressive: 110 countries are at some stage of looking into CBDCs.”

Kristalina Georgieva, managing director of the International Monetary Fund

“What a crazy concept this is, that we as a country embrace so many bright, young, talented people to come up with a replacement for our reserve currency. I wish all this passion and energy that went to crypto was directed towards making the United States stronger.”

Ken Griffin, founder of Citadel LLC

“The best way to look at it, if you’re an investor, either you believe in decentralized finance and centralized finance, and you believe in Bitcoin and Ethereum and the blockchain, or you don’t. If you don’t, stay in gold as a hedge, and if you do, tip into it.”

Kevin O’Leary, Shark Tank Judge

“I’m not going to get into any one token, but I think the securities laws are quite clear — if you’re raising money and the investing public have a reasonable anticipation of profits based on the efforts of others, that fits within the securities law.”

Gary Gensler, chairman of the U.S. Securities and Exchange Commission

“My bill with Congresswoman Ross would set disclosure requirements when ransoms are paid and allow us to learn how much money cybercriminals are siphoning from American entities to finance criminal enterprises — and help us go after them.”

Elizabeth Warren, U.S. senator

“Bitcoin’s $50,000 resistance point since May appears ripe to become the crypto’s support value in 4Q.”

Mike McGlone, senior commodity strategist at Bloomberg

Prediction of the Week

BTC bull run has ‘at least 6 months to go’ — 5 things to watch in Bitcoin this week

This week saw Bitcoin crack the $50,000 mark and continue upward past $55,000. Although upward price action accompanied the start of September, Bitcoin showed more of a downward trend for most of the month. Price action for BTC has posted upward pressure so far for October, but time will tell how the rest of the month plays out.

On a broader scale, in an Oct. 2 tweet, stock-to-flow model creator PlanB expressed the possibility that the current Bitcoin bull run still has several months of upward action ahead. “My guess: this 2nd leg of the bull market will have at least 6 more months to go,” PlanB said in the tweet, posting one of his BTC stock-to-flow models.

Several other factors are also relevant to determining Bitcoin’s outlook, including analyses of the asset’s hash rate estimates and technical indicators.

FUD of the Week

‘Evolved Apes’ NFT creator allegedly absconds with $2.7 million

Hodlers of the Evolved Apes NFT avatar project were left gobsmacked this week after one of the developers reportedly went rogue and swiped 798 ETH, worth around $2.9 million.

The anonymous developer who goes by the pseudonym “Evil Ape” is said to have dashed off with all the funds generated from the initial mint of the 10,000 tokenized apes, along with the gains from sales on the secondary market.

Apart from allegedly stealing 798 ETH, Evil Ape also took down the project’s website and Twitter account. There was also a blockchain-based fighting game that was promised by the project’s creators, and while the outlook is grim, the community is driving a recovery initiative dubbed “Fight Back Apes.”

Billionaire Ken Griffin slams crypto as ‘jihadist call’ against the greenback

Hedge fund manager Ken Griffin was the source of some mixed FUD this week as he slammed crypto as a “jihadist call” against the U.S. dollar.

Griffin, who is the founder of the $38 billion hedge fund Citadel LLC, and said that crypto is a “Jihadist call that we don’t believe in the dollar,” as he took aim at the pesky youth for spending so much time working on digital assets.

“I wish all this passion and energy that went to crypto was directed towards making the United States stronger,” he added.

The Citadel founder, however, stated that his firm is yet to enter the crypto sector due to the “lack of regulatory certainty,” suggesting that he’s more worried about compliance than a jihadist call against the precious greenback.

Gensler confirms SEC won’t ban crypto… but Congress could

SEC Chairman Gary Gensler said on Tuesday that his agency does not have the authority or intention to ban crypto, stating, “That would be up to Congress.”

However, Gensler highlighted that many crypto tokens fall under the enforcement power of the SEC. He singled out “financial stability issues” that arise from stablecoins as a key area of focus for the agency.

“It’s a matter of how we get this field within the investor consumer protection that we have and also working with bank regulators and others — how do we ensure that the Treasury Department has it within Anti-Money Laundering, tax compliance?” Gensler said.

Best Cointelegraph Features

Beyond Bitcoin: The future of digital assets is bigger than the first crypto

While Bitcoin is the most recognizable digital asset, it’s just one of many that are here to evolve financial services globally.

Money in 2030: A future where DeFi and CBDCs can work together

In coexistence with mutual benefits, decentralized finance and central bank digital currencies will finally make money universally available worldwide.

What it’s like when the banks collapse: Iceland 2008 firsthand

“Imagine if the money that you have in your bank account now would suddenly buy you 1/10th of what it had? That happened in a week.”