(adsbygoogle = window.adsbygoogle || []).push({});

Ever since the CEO of Twitter and Square, Jack Dorsey, started appreciating the crypto asset bitcoin, crypto enthusiasts have been following his coattails. However, there are very mixed views about Dorsey because while some people adore him, others are skeptical of his goals as his firm has been accused of mass censorship. Then on August 13, Dorsey tweeted out a URL link to a book called “Anatomy of the State” by the economist Murray Rothbard. The tweet not only attracted likes from bitcoiners but a number of libertarians were also confused by his tweet.

While Some Bitcoin Supporters Love Him, Many Other Crypto Advocates Don’t Trust Jack Dorsey

For quite some time now, the CEO of Twitter has been a bitcoin (BTC) supporter as he sports a Lightning Network emoji next to his username and keeps a bitcoin symbol in his Twitter bio. Jack Dorsey has also talked about the benefits of bitcoin on various occasions and recently tweeted about the vast number of Nigerians that leverage the crypto asset.

Dorsey’s other company Square allows merchants to accept bitcoin and people can purchase BTC via the Cash App as well. However, Dorsey is not liked by everyone and in fact, a great number of crypto supporters don’t like that he’s a maximalist, that his firm has censored individuals, and many believe he’s just a run-of-the-mill status quo figurehead from Big Tech.

Dorsey recently said that bitcoin would be a big part of Twitter’s future and recently discussed the subject of bitcoin with Ark Invest’s Cathie Wood and Tesla’s Elon Musk at the “B Word” event. Dorsey’s company Square is also in the midst of developing a bitcoin hardware wallet.

But while Dorsey was on stage at the Bitcoin 2021 conference in Miami he was heckled by a conference attendee over “censorship” and “interfering in elections.” Since the onset of Covid-19, just like Youtube, Facebook, and Instagram, Dorsey’s firm Twitter has been accused of mass censorship when tweets involved alternative discussions concerning the narrative surrounding the coronavirus and the 2020 election.

Twitter CEO Shocks Bitcoiners and Libertarians With Rothbard Book Tweet

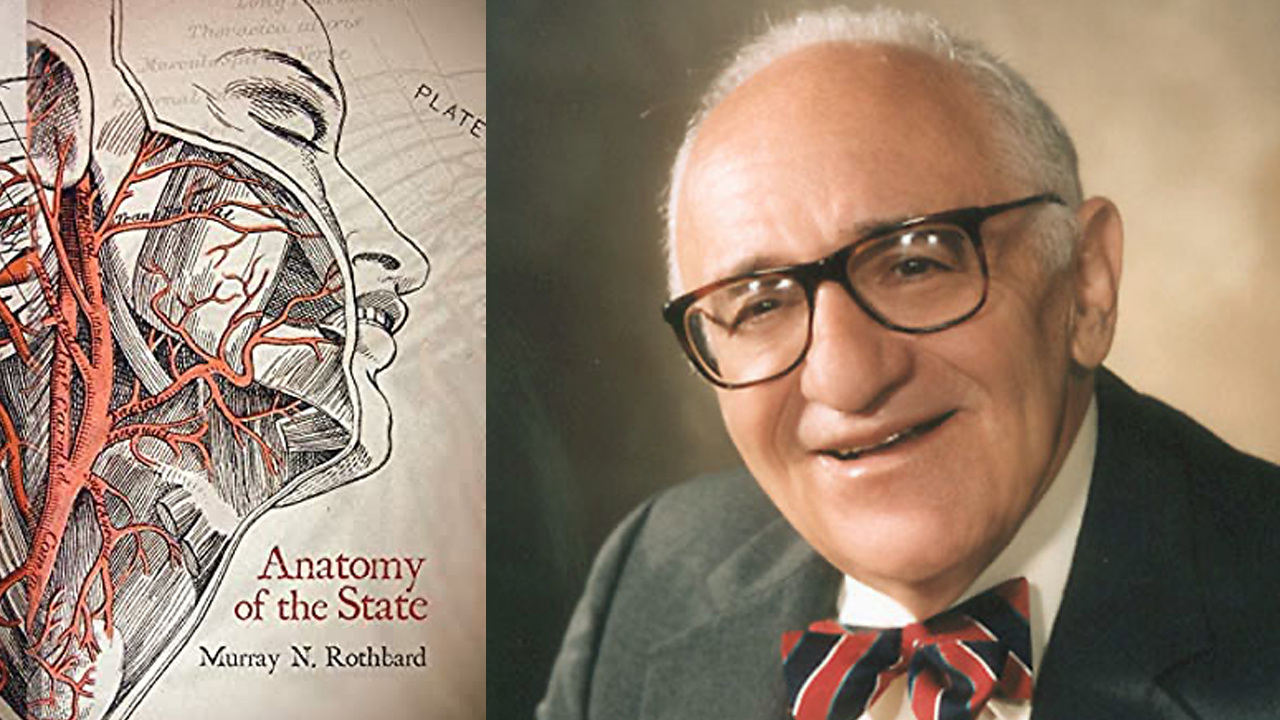

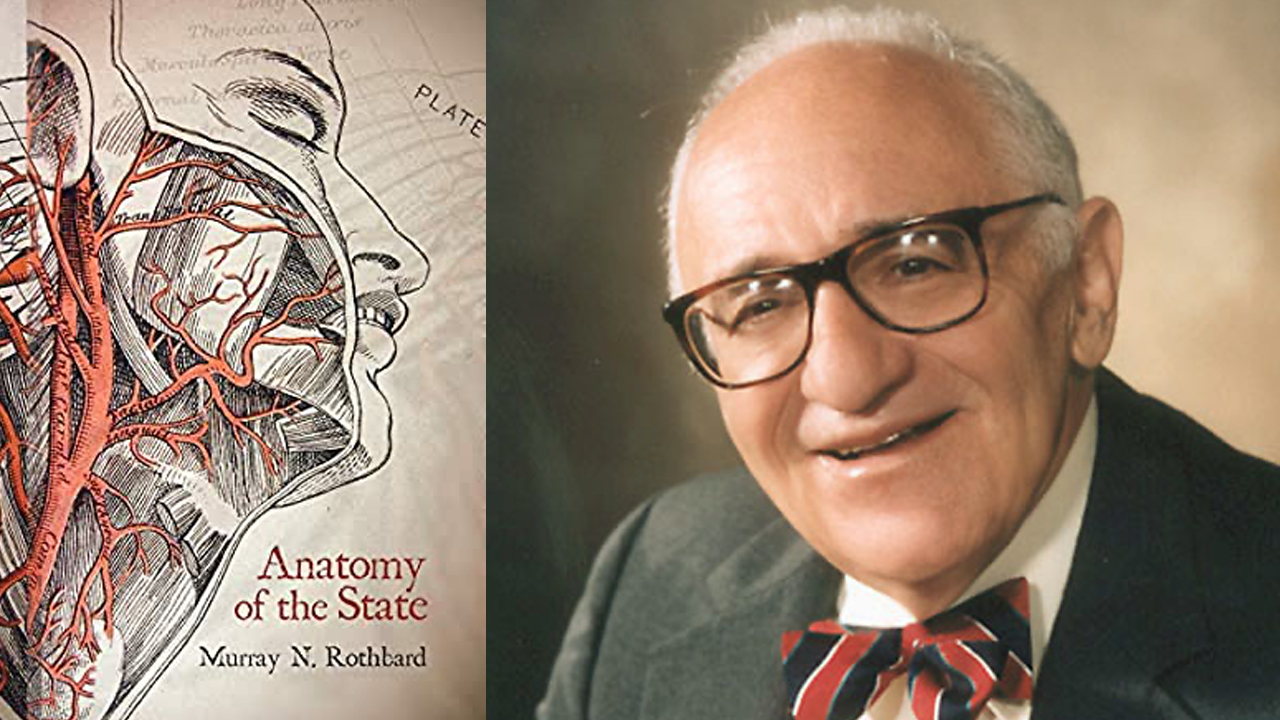

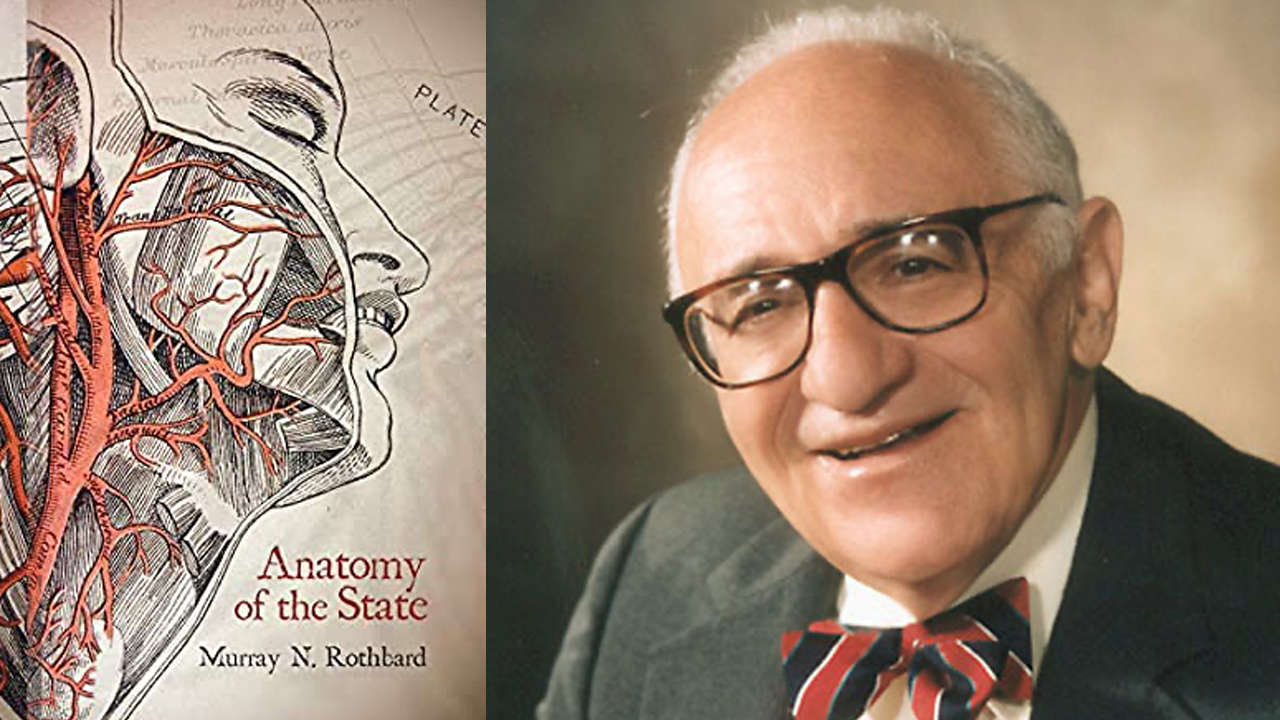

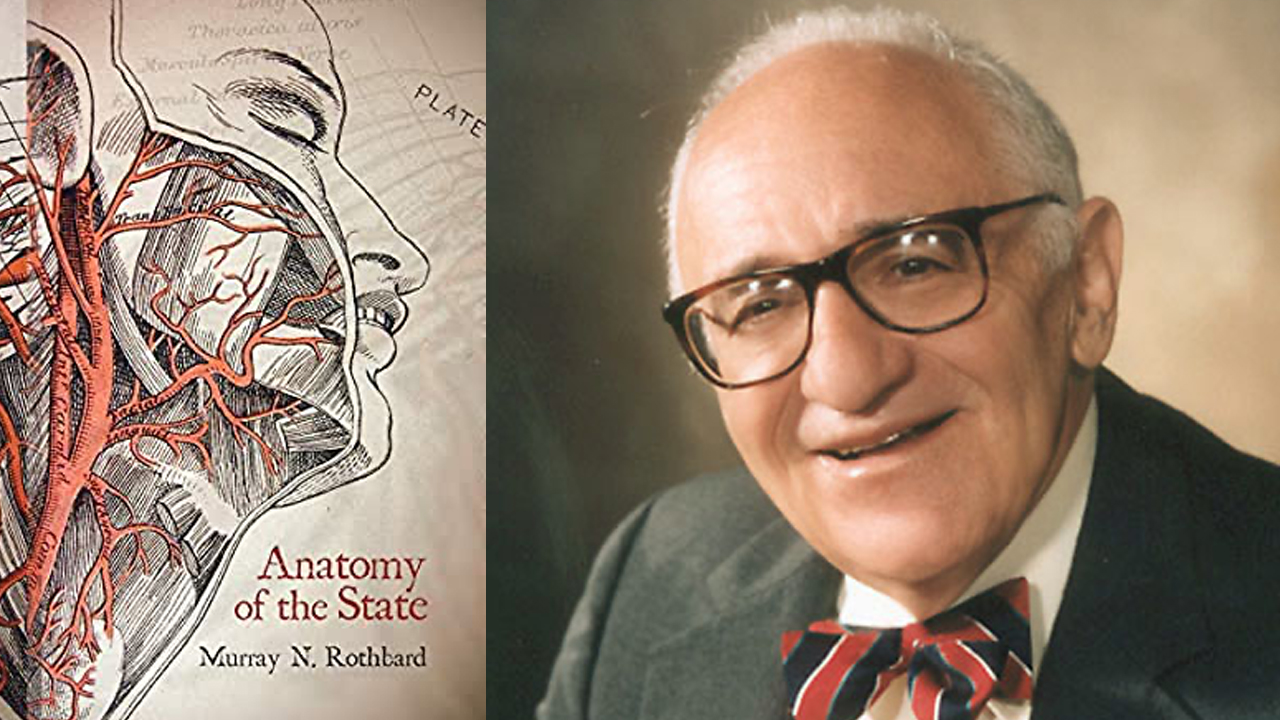

To many people’s surprise, on Friday the 13th, Dorsey shared a URL to Murray Rothbard’s magnum opus called “Anatomy of the State.” So far Dorsey’s Rothbard tweet has close to 13,000 likes and almost 2,000 retweets. The Twitter CEO even got the name “Rothbard” trending across Twitter since he shared the link stemming from Mises.org. It confused a number of bitcoiners and popular libertarian voices as well, because Dorsey is considered a leftist who still endorses the state.

The American economist Murray Newton Rothbard, on the other hand, was a leading theoretician of anarcho-capitalism and one of the founders of the Austrian School of economics. The reason people were confused by Dorsey’s tweet is that today’s neo-liberal ideals, something Dorsey is known for advocating, would almost certainly be scorned by Rothbard.

Free Market, Anti-War, and Anti-State

Rothbard’s book “Anatomy of the State” is considered one of the economist’s finest works and the first chapter, “What the State Is Not,” lays the groundwork of people’s false perceptions of the world’s nation-states. Essentially, the state is humanity’s enemy and the institution is a monopoly of violence that leverages force and coercion as a means to get its ends. Rothbard’s “Anatomy of the State” describes why the state is immoral and how the so-called “good intentions” are used as excuses for theft and manipulation. Rothbard’s famous magnum opus is wholeheartedly free market, anti-war, and anti-state.

“Since production must always precede predation,” Rothbard writes, “the free market is anterior to the state. The state has never been created by a ‘social contract’; it has always been born in conquest and exploitation.” The Austrian economist adds:

The State is that organization in society which attempts to maintain a monopoly of the use of force and violence in a given territorial area; in particular, it is the only organization in society that obtains its revenue not by voluntary contribution or payment for services rendered but by coercion.

We don’t know if Jack Dorsey’s tweet meant that he was moved by Rothbard’s book and words that describe the state or if it was just a Friday the 13th gag. It’s doubtful that the CEO of Twitter will become a Rothbardian after reading “Anatomy of the State,” but even though some bitcoiners and libertarians were skeptical, some thought that maybe Jack is changing ideological directions. Maybe the Twitter CEO realizes the value of voluntary cooperation and believes force and coercion are wrong?

What do you think about the CEO of Twitter sharing Murray Rothbard’s book “Anatomy of the State”? Let us know what you think about this subject in the comments section below.

Tags in this story

Anarcho-capitalism, Anatomy of the State, anti-state, Anti-war, Austrian School, Austrian School of Economics, Bitcoin, Bitcoiners, Censorship, COVID-19, Free Market, Jack Dorsey, libertarians, Monopoly of Violence, Murray Rothbard, NAP, square ceo, Twitter CEO, Voluntarism, Voluntaryism, What the State Is Not

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.