Cryptocurrency prices and investor sentiment reversed course on Dec. 15 after Federal Reserve chairman Jerome Powell confirmed the bank’s plan to hike interest rates in 2022 and slow down the bond purchasing program that had been in play since the emergence of the coronavirus in March 2020.

Following the announcement, Bitcoin (BTC) price tacked on a 1.65% gain, bringing the price above $49,000 and Ether trekked back above the $4,000 mark. Altcoins followed suit with their usual double-digit gains and for the moment, it appears as if bulls have taken back control of the market.

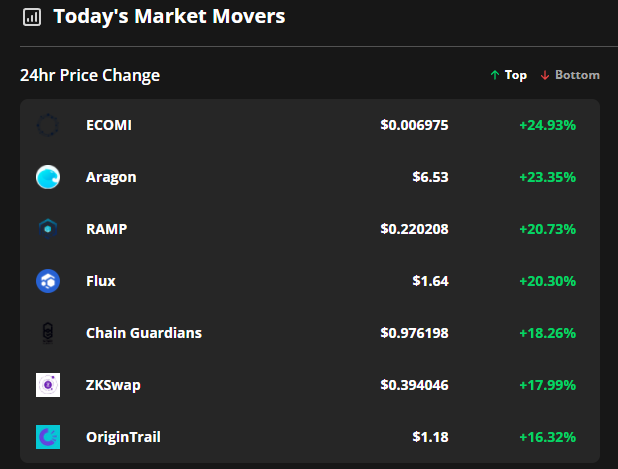

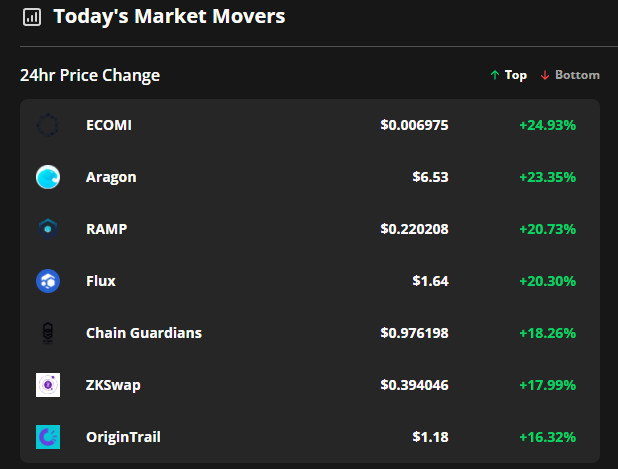

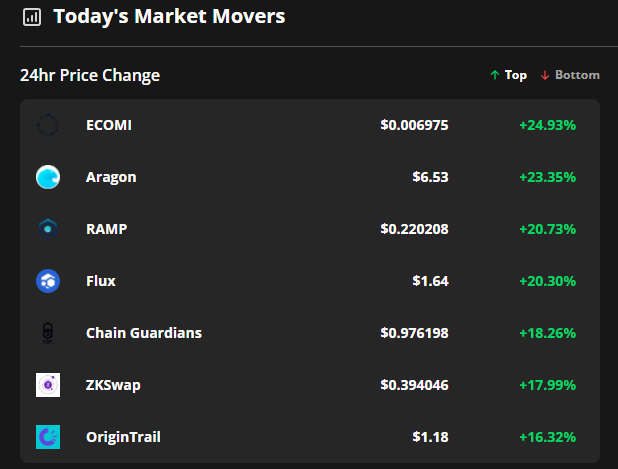

Data from Cointelegraph Markets Pro and TradingView shows that the biggest gainers over the past 24-hours were ECOMI (OMI), Aragon (ANT) and RAMP.

ECOMI migrates to Immutable

ECOMI is a technology company focused on building a blockchain-based digital collectibles marketplace where users can buy and share nonfungible tokens (NFTs) across the social network service using the project’s native OMI token as a medium of exchange.

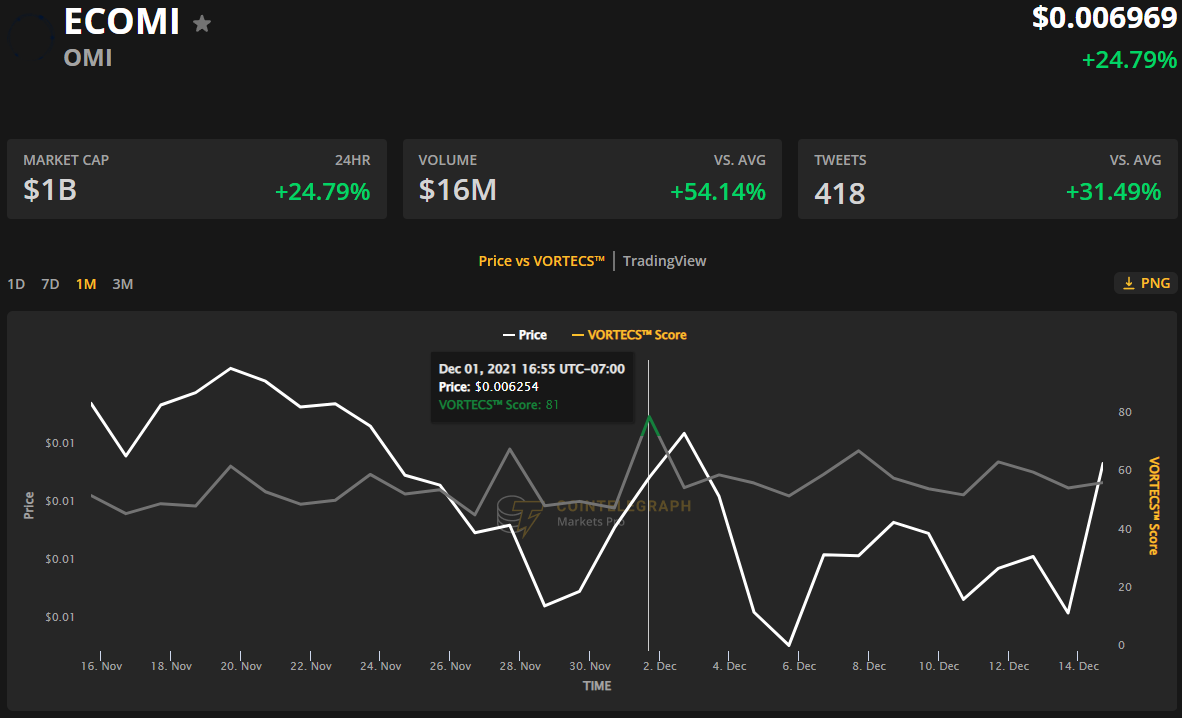

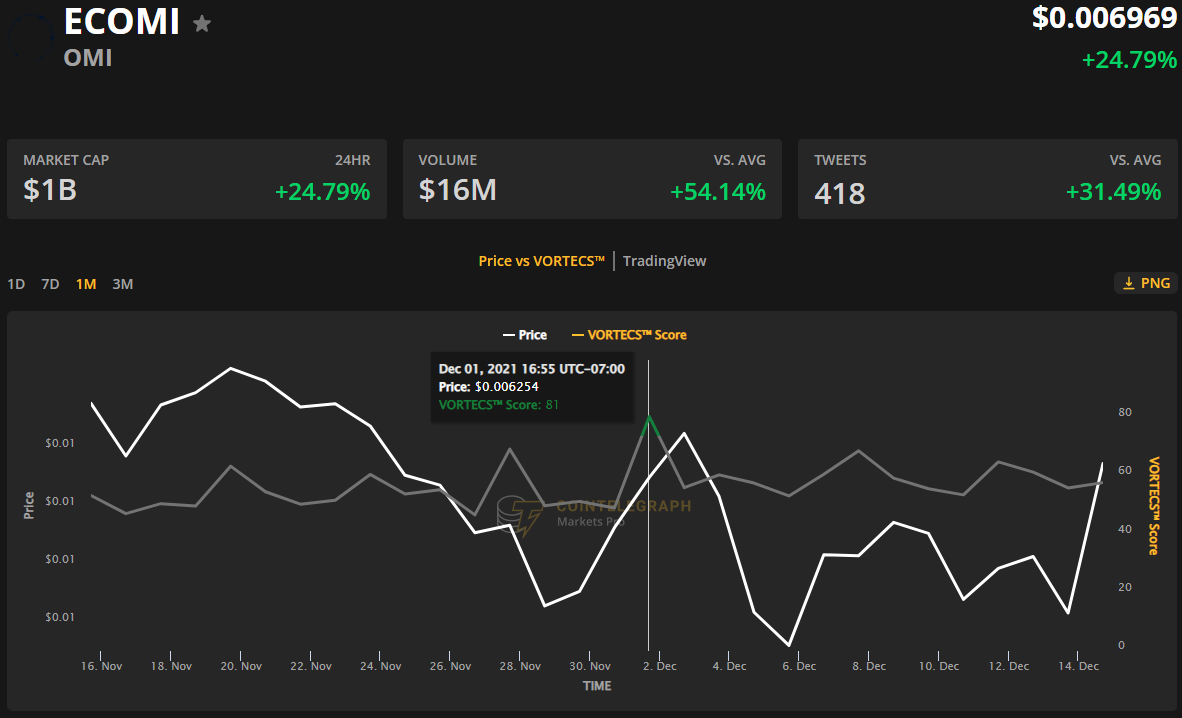

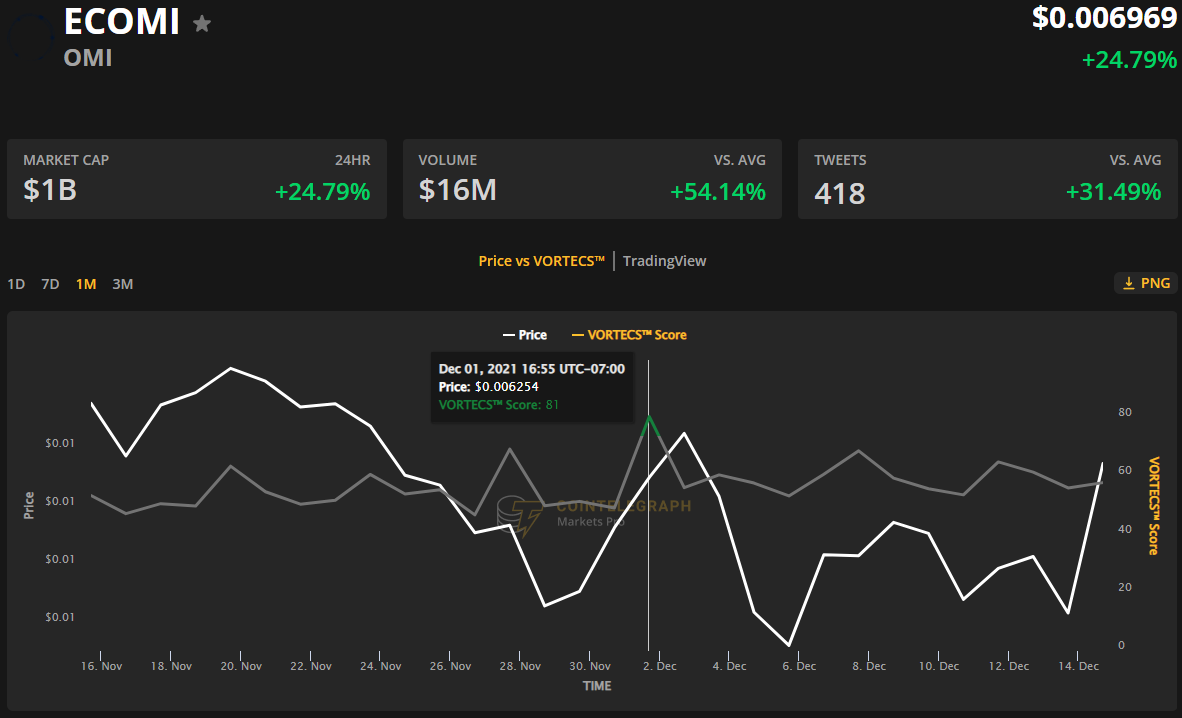

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for OMI on Dec. 1, prior to the recent price rise.

The VORTECS™ Score, exclusive to Cointelegraph, is an algorithmic comparison of historical and current market conditions derived from a combination of data points including market sentiment, trading volume, recent price movements and Twitter activity.

As seen in the chart above, the VORTECS™ Score for OMI climbed into the green zone and reached a high of 81 on Dec. 1, around 96 hours before the price began to increase 39% over the next ten days.

The building momentum for OMI comes as the ECOMI ecosystem migrates to Immutable, an Ethereum (ETH) scaling solution specifically designed for NFT projects.

Aragon hosts a DAO hackathon

Aragon Ethereum network-based protocol that supports decentralized autonomous organizations (DAOs) developing governance structures to encourage community engagement.

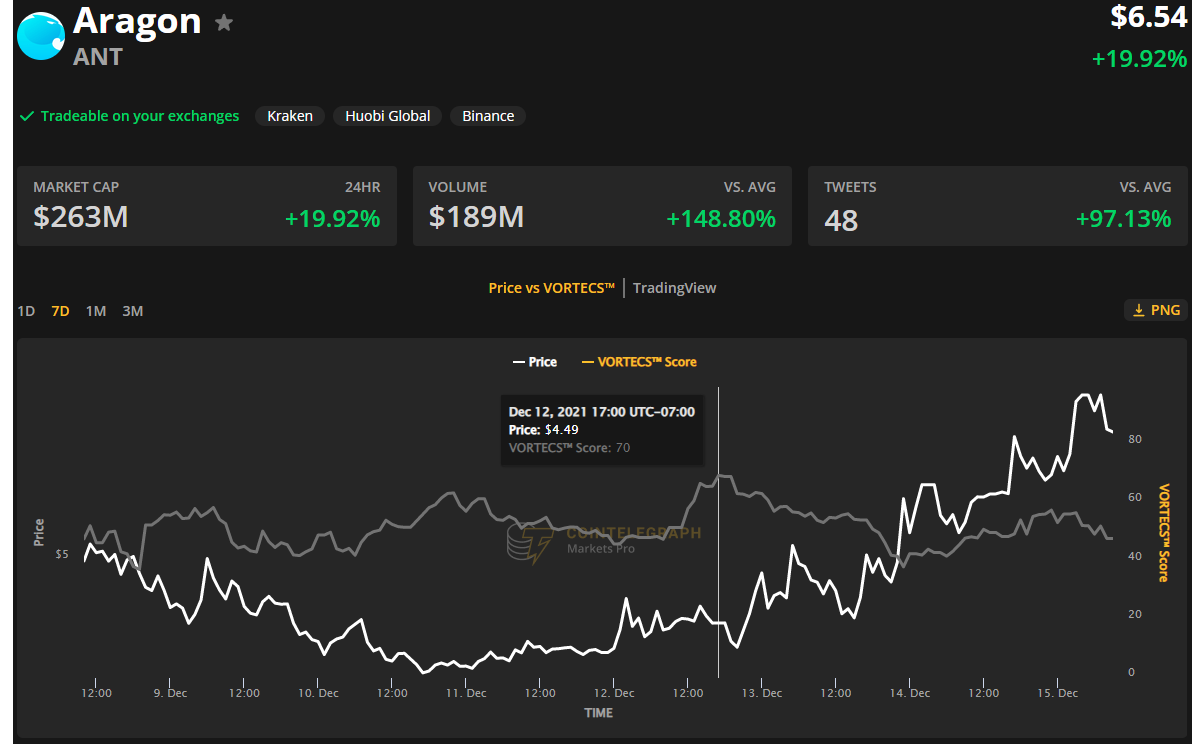

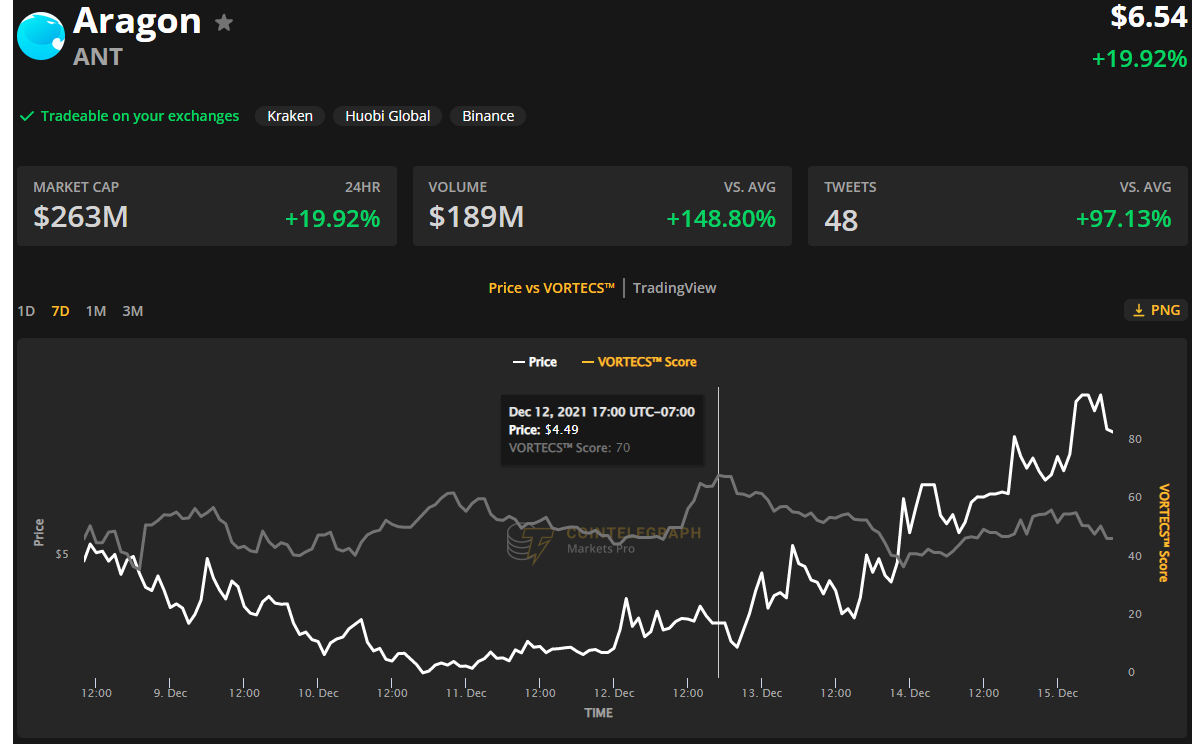

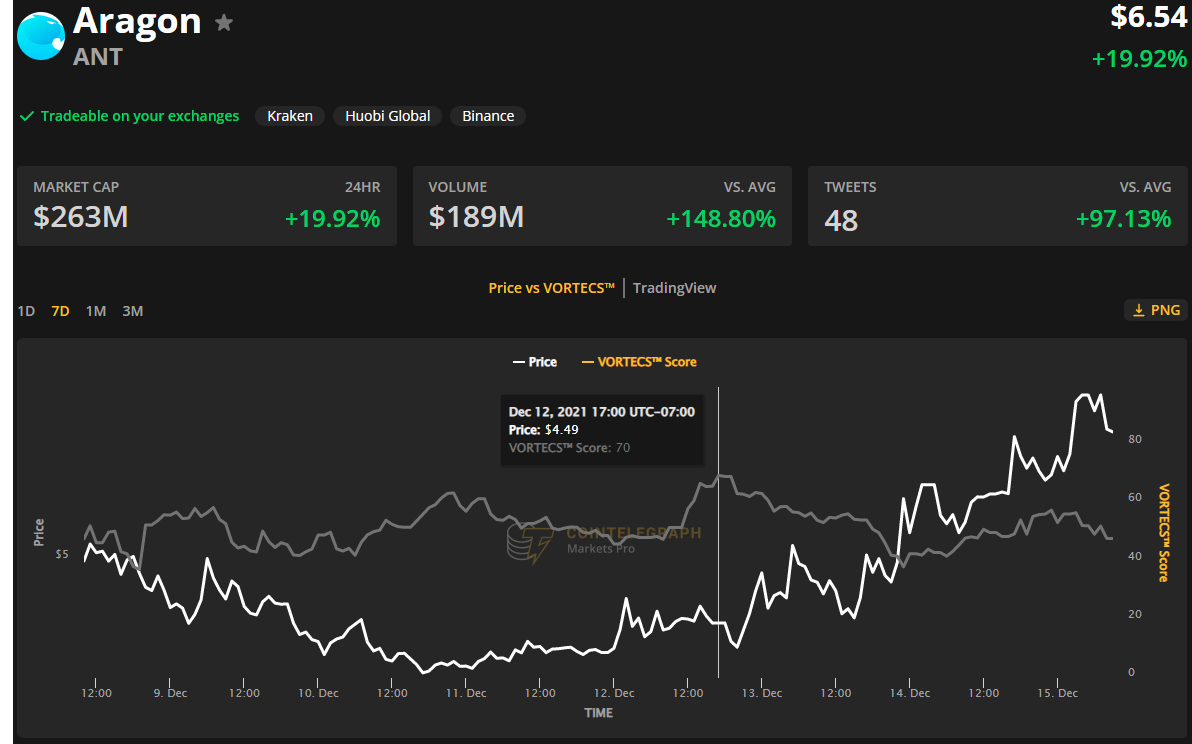

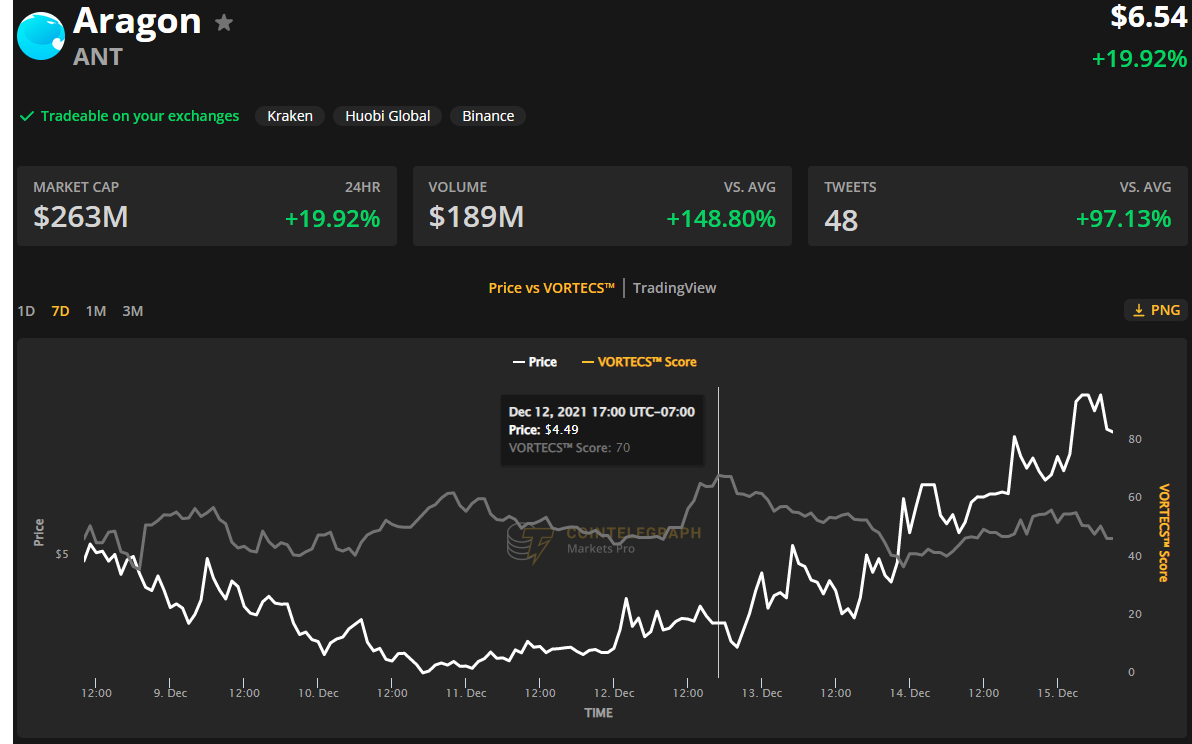

VORTECS™ data from Cointelegraph Markets Pro began to detect a bullish outlook for ANT on Dec. 12, prior to the recent price rise.

As seen in the chart above, the VORTECS™ Score for ANT began to pick up on Dec. 12 and reached a high of 70 around two hours before the price began to increase 60% over the next two days.

The rally in ANT price is taking place at the same time as a DAO global hackathon aims to attract developers to the Aragon ecosystem and there are rumors that the DAOpunks NFT project conduct an airdrop to ANT holders.

Related: Bitcoin sheds ‘dumb money’ as retail buys most BTC since March 2020 crash

RAMP benefits from liquidity mining incentives

RAMP is a multi-chain decentralized finance (DeFi) protocol that helps investors become more capital efficient.

Data from Cointelegraph Markets Pro and TradingView shows that after hitting a low of $0.179 on Dec. 14, the price of RAMP spiked 52.56% to a daily high at $0.274 on Dec. 15 as its 24-hour trading volume surged 800% to $54.2 million.

The price spike for RAMP came after the launch of a liquidity mining incentive program resulted in a sharp uptick in the total value locked in the protocol. Currently there is $63.3 million invested across Ethereum, Polygon and Binance Smart Chain.

The overall cryptocurrency market cap now stands at $2.126 trillion and Bitcoin’s dominance rate is 41.7%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.