Spot gold last week hit its highest price level since Jan. 8 after dipping to as low as $1,680 in early March.

13424 Total views

(adsbygoogle = window.adsbygoogle || []).push({});

5 Total shares

In the aftermath of the Mid-May crypto market sell-off, gold has seen significant price recovery.

Gold prices continued to inch higher on Tuesday, hitting $1,887 per ounce at 3:00 am EDT, according to data from TradingView.

Last week, gold reached its highest price level since Jan. 8 at $1,889, marking a four-month high after gold prices dipped to $1,681 in early March. At the time of writing, spot gold is trading at $1,882, up around 0.1% over the past 24 hours.

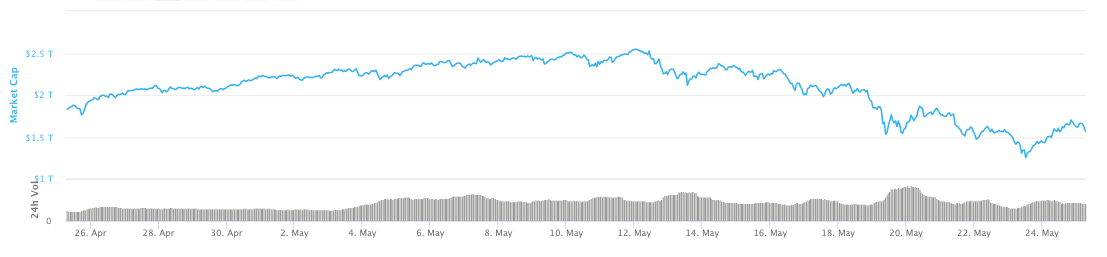

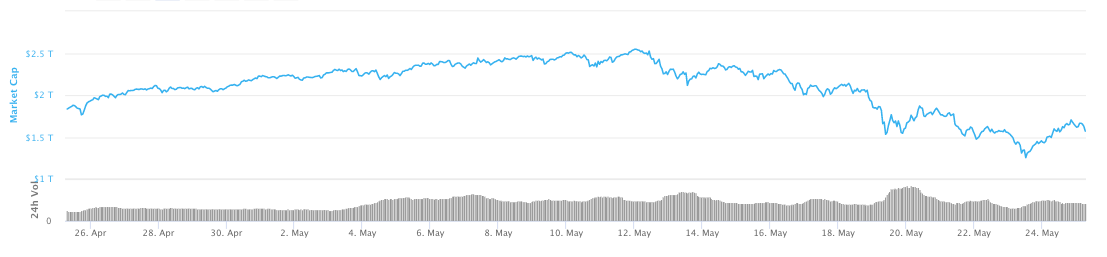

The accelerated growth of the gold market came along with a major downturn in cryptocurrency markets that started on May 12. After topping above $2.5 trillion, the total crypto market capitalization started seeing consecutive slumps, eventually sinking below $1.3 trillion on Sunday, according to data from CoinMarketCap.

According to Bob Haberkorn, a senior market strategist at brokerage firm RJO Futures, growing gold prices could be attributed to a weaker dollar accompanied by lower United States Treasury yields. “If the data comes out substantially better than expected, that would probably be bearish for gold because the likelihood of a Fed taper will be sooner rather than later,” he said.

A number of financial analysts have drawn parallels between the trends in the crypto and gold markets, with JPMorgan experts suggesting last week that large institutional investors were dumping Bitcoin (BTC) in favor of gold.

According to the bank, the new trend reversed a major bullish market driving Bitcoin’s price above $64,000 in mid-April. At the time of writing, Bitcoin is trading at $37,111, rebounding after touching $30,000 last Wednesday.

![]()

![]()