A new GamesBeat event is around the corner! Learn more about what comes next.

(adsbygoogle = window.adsbygoogle || []).push({});

Immutable has raised $60 million for its platform that uses nonfungible tokens (NFTs) to help monetize games.

The Sydney, Australia-based Immutable created a platform on top of Ethereum to monetize NFTs in games, and it is also the creator of the Gods Unchained NFT-based collectible card game. NFTs use the transparent and secure ledger of blockchain to uniquely identify digital items. That means that rare digital items can be sold for higher prices in NFT-based games.

The company also recently unveiled it will issue a $GODS token. It will give them out or sell them to players so they can have a voice in how the studio runs the game. At launch, $GODS will operate as a utility and governance token, giving holders a voice in the digital space, as well as active staking opportunities that allow players to earn rewards through gameplay campaigns.

Over time, functionality of the $GODS will expand to embed the token within Gods Unchained’s “play-to-earn” game loops, enabling players to earn $GODS tokens as rewards when people play the game. If those tokens increase in value, the players can sell them for their own profit. I call this the Leisure Economy, where we all get paid to play games. Immutable hopes the biggest game companies will adopt NFTs, which have been popular with crypto enthusiasts but are somewhat confusing for ordinary gamers.

Webinar

Three top investment pros open up about what it takes to get your video game funded.

“It’s exciting,” said Robbie Ferguson, the cofounder of Immutable, in an interview with GamesBeat. “The biggest thing we’re looking to build is a set of tools that mainstream developers can use to build NFT games without ever having to worry about blockchain.”

The tools include ways to enable credit card purchases, anti-money laundering services, know-your-customer regulatory compliance, and more when it comes to implementing NFTs in games.

“We can provide for the end-to-end needs of the mainstream client,” he said.

The NFT hype

Above: Gods Unchained is a collectible card game.

Image Credit: Immutable

The market for NFTs surged to new highs in the second quarter of 2021, with $2.5 billion in sales in the first half of the year, up from just $13.7 million in the first half of 2020. NFTs have exploded in other applications such as art, sports collectibles, and music. NBA Top Shot (a digital take on collectible basketball cards) is one example.

Published by Dapper Labs, NBA Top Shot has surpassed $750 million in sales in just a year. And an NFT digital collage by the artist Beeple sold at Christie’s for $69.3 million. Investors are pouring money into NFTs, and some of those investors are game fans. The weekly revenues for NFTs peaked in May and then crashed, but in August those revenues were bigger than ever.

But there are drawbacks too in numerous scams where people steal art and sell it as their own NFTs.

Noting the spike in NFT sales, Ferguson said, “Look, I think we’re in a hype cycle. At the moment, I think people are buying these entities on an expectation of profit. It’s going to crash, crash in a big way. It’s a speculator boom. Every boom is good because it brings a lot of adoption. You can’t really have perfect speculation. You’re always worried it’s going to go up or down. The thing I am excited about is the transition into utility-based NFTs.”

He believes his company has been able to successfully raise money because it is focusing on infrastructure, not fad-like digital items that could go out of fashion easily. It’s also making games that people enjoy playing, like Gods Unchained. Building games like that helps the company understand the needs and requirements for the infrastructure, he said.

“We’ve been through two bear markets as a company already, so we’re ready for anything,” Ferguson said.

Immutable X protocol

Above: The $GODS Unchained token.

Image Credit: Immutable

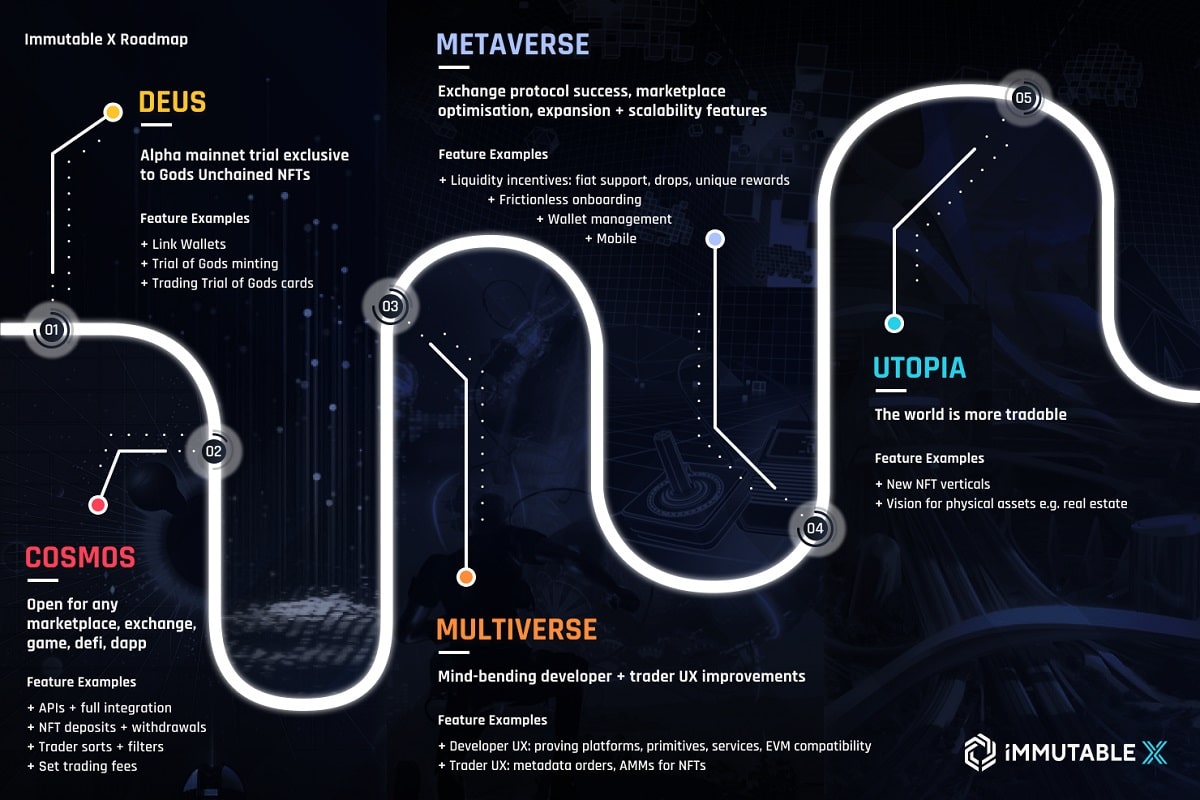

Immutable has also created Immutable X, a Layer-2 scalability protocol for NFTs on Ethereum. That means it enables transactions at a much faster rate than was intended on Ethereum, and it doesn’t use as much computing power and so doesn’t have as many environmental effects as transactions on top of Ethereum normally do. On top of that, it doesn’t incur the high “gas fees,” or computing fees, for users. Those fees are zero, and yet they don’t compromise on security because they take advantage of the underlying secure Ethereum platform.

In an earlier interview, Ferguson said that in 2020 Immutable found the solution on the crypto frontier with StarkWare, which tapped the benefit of using the Ethereum cryptocurrency and its security without incurring huge fees. Immutable X is built on top of Starkware’s “Layer 2 scaling” technology. The bottom line is that users don’t have to trust in Immutable lasting permanently in order to keep owning their NFTs. They can just trust in Ethereum. Immutable X’s mainnet is now available as a Layer 2 solution for NFTs on Ethereum.

“At the end of the day, this security is the whole point,” Ferguson said. “Otherwise, you might as well just make a new centralized database.

“What our company has become focused on is to scale these games and these applications in a way that is best for users, and ultimately, still decentralized, while still being super easy for mainstream applications to use. That’s why we decided to build Immutable X. We spent a very long time searching for a scaling solution. We’ve got to make the proposition of NFT ownership available to everyone.”

Other solutions to Ethereum are creating alternative, faster cryptocurrencies with different methods of reaching a consensus. But these alternatives aren’t as popular as Ethereum. Another solution is to create a side chain, with a different kind of processing for transactions. But Ferguson said those solutions can fail because their security isn’t still as strong as Ethereum’s. If the security fails, then so does the authenticity of the NFT, and that would be disastrous, Ferguson said.

“We use Ethereum for everything we do. We’re just compressing the data on it by zero-knowledge proofs [a verification technique], which allows us to reach really high levels of scale,” Ferguson said.

Transaction speed

Immutable X can handle 9,000 transactions per second, much more than Ethereum, which is the most popular blockchain. That puts Immutable on a scale to support games with millions of players. As Ethereum network traffic has increased significantly, transactions are slower and costlier to execute, and security is increasingly important. Over time, Ferguson said that should grow.

Immutable X was created with these pain points in mind. The scaling protocol was built with StarkWare’s ZK-rollup, capable of massive scalability without compromising security. Last month, $600 million was hacked on less secure scaling solutions which rely on centralized “bridges” for their connection to Ethereum, rather than zero-knowledge proofs, the company said.

Immutable X has a marketplace for players in games such as Gods Unchained to buy and sell the items they have collected. Games such as Immutable’s upcoming Guild of Guardians will mint its NFTs on the carbon-neutral Immutable X platform.

The funding

Above: Gods Unchained pays to play.

Image Credit: Immutable

All of these things — the games, the players, the protocol, and the marketplace — have made the company valuable. Bitkraft Ventures and King River Capital led the round, with participation from Prosus Ventures, Galaxy Interactive, Fabric Ventures, Alameda Research, AirTree Ventures, Reinventure, Apex Capital, and VaynerFund.

The funding will be used to expand the global engineering and sales team, and strengthen key partnerships with gaming companies. It will also be used to scale the growth of Immutable’s in-house published NFT games, Gods Unchained and Guild of Guardians.

Ferguson said his company has 120 employees and hopes to grow to 200 within six months.

As to the competition, Ferguson noted there are other major blockchains with an eye on NFTs, including Flow (owned by Dapper Labs), Polygon, Solana, and others who are “coming out of the woodwork.” He said this is a good thing because “the most important mission that we’re doing is we want to make digital worlds real. And that means giving people ownership of their stuff in a secure decentralized blockchain. And so as long as the winning solution is something that’s actually secure and decentralized, I’m happy.”

He noted that Immutable is in a good position because it has been working on its tech for more than two years.

Game partners

Above: Guild of the Guardians has teamed up with esports organization NRG.

Image Credit: Immutable

From collectible trading card NFTs to fashion NFTs, Immutable’s technology partnerships span across multiple industries.

Immutable’s own Gods Unchained is led by Chris Clay, the former game director of Magic the Gathering Arena, and Immutable is also making Guild of the Guardians.

Other notable projects include:

- OpenSea (NFT marketplace)

- Mintable (NFT marketplace)

- RTFKT studios (fashion NFT artists)

- Ecomi/VeVe Collectibles (licensed collectibles)

- Medal.TV (world’s largest gaming clips website)

- HighRise (social sandbox)

- TokenTrove (collectibles marketplace)

- SuperFarm (defi NFT farm)

- Epics.GG (whitelabel marketplace platform for NFTs)

- Illuvium (auto battler RPG)

- Lucid Sight (MLB Champions Baseball, Crypto Space Commander)

- War Riders (post-apocalyptic MMO)

- Mintable (NFT marketplace)

- Double Jump.Tokyo/MCH+

There are 10 or so major partnerships with game companies already announced, and that should expand in the coming months, he said.

“The most exciting thing by far is the interest from the massive game companies,” said Ferguson. “They say they have an NFT strategy that has been accelerated by three or four years. We see all of the major game studios around the world have dedicated teams to work out what their NFT strategy is, and some are building defensive strategies. We’re going in aggressively and saying we can be the market leader in NFT experiences for gamers.”

GamesBeat

GamesBeat’s creed when covering the game industry is “where passion meets business.” What does this mean? We want to tell you how the news matters to you — not just as a decision-maker at a game studio, but also as a fan of games. Whether you read our articles, listen to our podcasts, or watch our videos, GamesBeat will help you learn about the industry and enjoy engaging with it.

How will you do that? Membership includes access to:

- Newsletters, such as DeanBeat

- The wonderful, educational, and fun speakers at our events

- Networking opportunities

- Special members-only interviews, chats, and “open office” events with GamesBeat staff

- Chatting with community members, GamesBeat staff, and other guests in our Discord

- And maybe even a fun prize or two

- Introductions to like-minded parties

Leave a Reply Cancel reply

document.addEventListener(‘DOMContentLoaded’,function(){var commentForms=document.getElementsByClassName(‘jetpack_remote_comment’);for(var i=0;i<commentForms.length;i++){commentForms[i].allowTransparency=false;commentForms.scrolling='no';}}); <!–