sponsored

Non-Fungible Tokens (NFTs) have been around for some time now, with what is recognized as the first-ever NFT “Quantum” created back in 2014. Since then, the industry has evolved and grown into what you see today; a flourishing and wholly absorbing market built on the Ethereum blockchain, offering a mixture of scarcity and provability, which equates to real value through digital ownership.

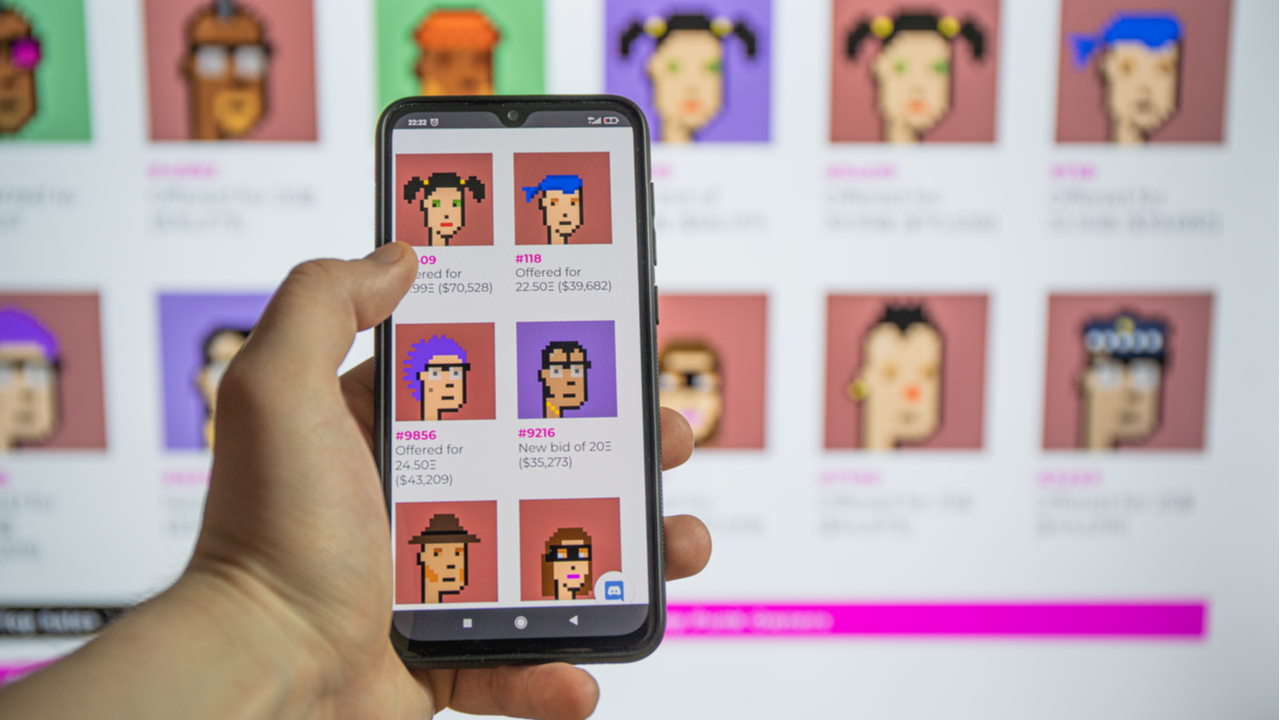

Mainstream media coverage of NFTs focuses on CryptoArt, which is a unique look at art media, based on a decentralized blockchain. The relationship between the NFT world and the art world is one that has formed quickly and naturally, adding credence to the concept of CryptoArt and another reason why this industry should receive the recognition it deserves. It has frequently been labelled as a bubble because the advent of the industry is portrayed to have occurred at the start of 2021. However, a quick glance at the timeline of NFTs and it’s clear that the community has been around for a while. Though, the market really began to swell between 2018-2020, before exploding at the start of 2021—coinciding with the soaring popularity of NFT exchanges. At the turn of the year, NFT marketplace lists were bustling with buyers from across the globe, as people were learning how to buy NFTs.

There has been a rise in the number of NFT art marketplaces, offering a platform for artists and collectors to interact and purchase collectibles at an allocated NFT crypto price. This bubbling marketplace is paving the way for artists to gain exposure and reach their audience. Within the art space alone, NFTs can take the form of digital moving art, high-quality digital files of art pieces created offline, creative sounds and music. While NFTs have been around for years, the industry is still in its infancy and will continue to push the envelope of what’s possible in space.

You are already seeing the evolution of digital media into Playable NFTs with the launch of collections like ArcadeNFTs, allowing owners to access a unique interactive retro game. Each ArcadeNFT drop has sold out, not just because of its interactive NFTs, but also a growing fanbase communicating on its Discord server and building a lasting community of NFT devotees. The birth of Gamable NFTs is just the beginning of the creative and innovative expression of the community. As funding and investment increase, you’ll start to realize the vision of NFT developers and enthusiasts.

NFTs: Then and Now

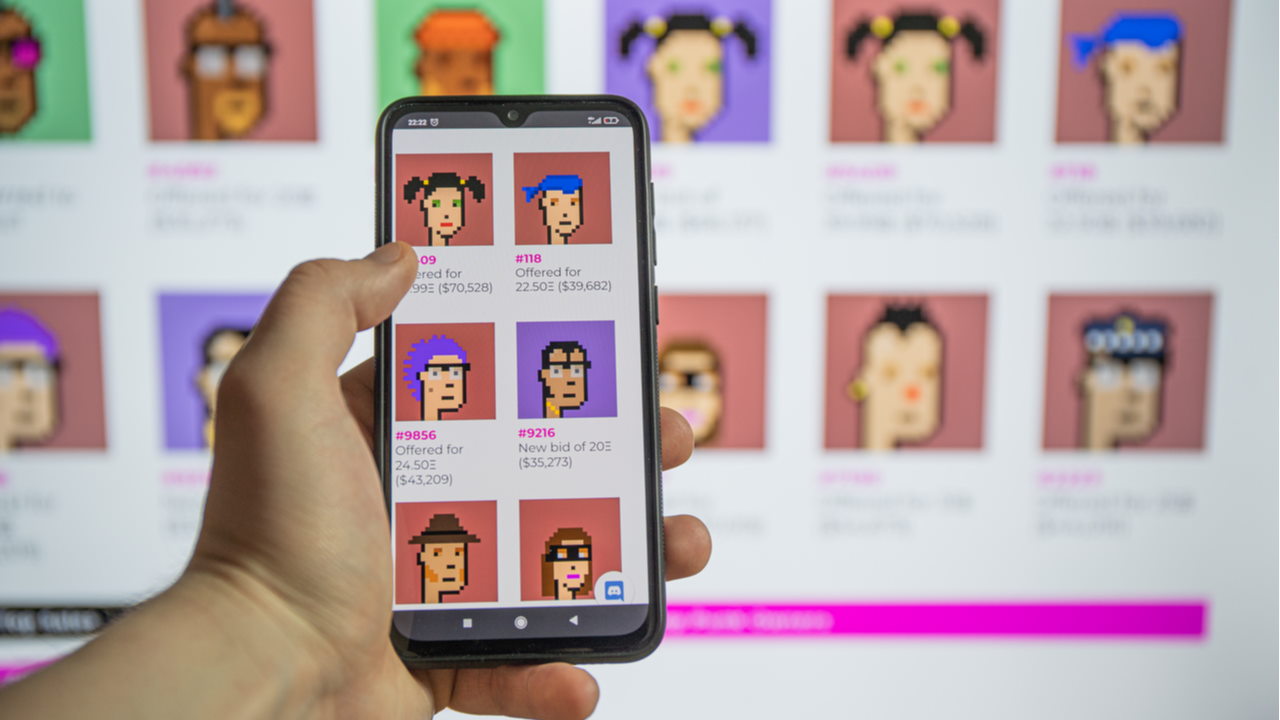

The story of NFTs stretches back to the first years of crypto, back to 2012. From colourful coins to trading cards, NFTs have always been present. But, when this exciting medium really began to find its identity was around 2016 when the already established Counterparty platform posted the collection of rare “Pepes.” A seminal collection built on the Bitcoin blockchain, before being released on the Ethereum blockchain the following year under the name “Peperium.” In the same year, 2017, the release of 10,000 unique “Cryptopunks”, which were originally given away for free to anyone who held an Ethereum wallet. Fast-forward four years and those pixelated heads are reaching over $5 million.

Over the course of the next 2 years, there were many notably NFT collections released; the likes of CryptoArte, EtherRocks, and interactive virtual game collections like CryptoKitties. Throughout this period, it still wasn’t clear how to buy an NFT and this meant that the market remained underground—only for those crypto evangelists out there. Until 2018-19, when the NFT ecosystem experienced significant growth, led by trading platforms like OpenSea and SuperRare, which remain some of the best NFT marketplaces in operation today. The fast-moving NFT ecosystem was supported by the development of Web3 wallets, Eidoo and MetaMask, allowing users to quickly and easily gain access to the marketplace.

With a focus on collaboration and community, we’re seeing the rise of decentralized autonomous organizations (DAOs) which offer social platforms with no central leadership, instead, they’re governed by the community from the ground up. Within the NFT sphere, you have the likes of Friends with Benefits, which requires members to have 75 $FWB in order to join, offering a space to discuss and collaborate on NFT projects. Token-based communities with a focus on NFT collection and driving design projects.

The NFT ecosystem has benefitted from the rapid growth of the cryptocurrency industry to the point that now there are various websites offering NFT reviews and comparisons between crypto wallets, NFT marketplaces, games, and collectibles. The pioneering NFT collections will be remembered as significant moments for the industry that will live on forever, but it’s the future of NFTs that is rousing. The rawness of the marketplace, knowing that every project is an experiment, pushing the boundaries of what’s possible. Designers work to create new opportunities and test them to see how NFTs could transition into the mainstream. The possibilities are endless.

NFT Authenticity

Given that an NFT is held digitally, what stops people from screenshotting an NFT and making it into a JPG? Well, you cannot sell an NFT unless it’s registered on the blockchain and is the original version. The movement and financial implication of each transaction are recorded on the blockchain, thereby providing a timeline for each NFT and making it easy to prove its validity through a digital archive. Once a transaction has taken place it cannot be erased or altered, which is what gives NFTs their authenticity. The distinction between ownership of art and ownership of code that manifests as images, or interactive media, of art, is quite pertinent. NFTs are not art per se, they are designed to be used as tools for authentication, providing artists with independence to create and sell their artwork without an intermediary. With the market thriving and now that NFT collectors know exactly where to buy NFTs, the innovators are exploring other functionality these tokens offer.

Real World Use Cases for NFTs

The foundations of NFTs—authentic, tokenized, royalties, scalable—may lend to the development of technologies that could improve everyday life. There is much speculation about how the industry can influence other sectors, with many casting a sizable net in terms of possibilities for NFTs. However, a more conservative vision still offers a very exciting future. Without delving too deep into each individual sector, these look to be the main areas for utilizing NFTs in the near future:

- Art NFTs

- Collectible NFTs

- Interactive Gaming NFTs

- Logistics NFTs

- Property Ownership NFTs

For Art, Collectible, and Gaming NFTs, you have mostly covered how these work. CryptoWisser expects the development of the industry to provide a platform for the ecosystem to grow and serve these various use cases. In terms of logistics, supply chains would benefit greatly from NFTs transparency, serving as a source of validity and reliability for goods. This is especially useful when it comes to perishable goods, where data regarding stages of the supply chain and the number of units is of great value. Moreover, as is the nature of the blockchain, each record is unique and allows distributors to track a single product from its origin to the final destination. This kind of technology is something that logistics organizations have been battling for decades, employing archaic methods of recording data.

The same concept is applicable to recording ownership of real-world assets. NFTs make proof of ownership seamless, which could flip the script for the real estate and music industry, to name a few. Both of these industries have an overabundance of intermediaries involved in the process of what should be a transaction made between buyer and seller. The goal would be to simplify and streamline the process, putting the power back in the hands of individuals and relieving them of reliance on unnecessary bureaucracy. This same concept could be applied to almost any asset, making the transfer of ownership a simple process controlled entirely by the owner.

Closing Thoughts

The soaring popularity of NFTs will likely lead to more mainstream adoption, not just from the public but also businesses looking to utilize the technology. As such, the use cases mentioned are likely to be just a drop in the ocean of what you’ll see in the future. Yet, for now, many of the projects are still small and lack the funding to realize their full potential. The sheer volume of non-bankable properties would mean that NFTs for digital ownership and verification are here to stay.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.